The UK-based defense manufacturing company BAE Systems PLC (GB:BA) witnessed higher demand for its products in the last year. The stock jumped by 43% in the last year, making it one of the top performers on the FTSE 100 index. Analysts are still highly bullish on the stock and have rated it a Strong Buy.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

BAE Systems manufactures and provides defense products to the air, land, and marine sectors. The company owns some of the most advanced defense solutions in the world and operates in around 40 countries.

Let’s see what makes analysts so bullish on the stock.

The Bull Case

BAE Systems holds a dominant position in its sectors and is well-placed to benefit from increased defense budget spending globally. As we currently live in a world of global insecurities, higher demand for military hardware makes a strong case for BAE and its diverse range of products.

The company’s strong order book, which spans the long term, provides clarity for top-line growth. As of December 31, 2022, the company’s order backlog was £58.9 billion, of which £37 billion were added during the year. Revenues increased by 4.4% to £23.3 billion in 2022.

For 2023, BAE expects another solid year with expected growth of 3-5% in its sales, margin expansion, and higher EPS.

Two months ago, analyst Charles Armitage from Citigroup raised his price target from 1,038p to 1,146p and reiterated his Buy rating. Armitage believes the company’s guidance numbers for 2023 are “somewhat conservative,” and the current foreign exchange rates will further act as a tailwind.

BAE Systems’ Dividends

The company has been a reliable dividend payer over the last few years. It was also among the few companies that didn’t cut dividends during COVID-19.

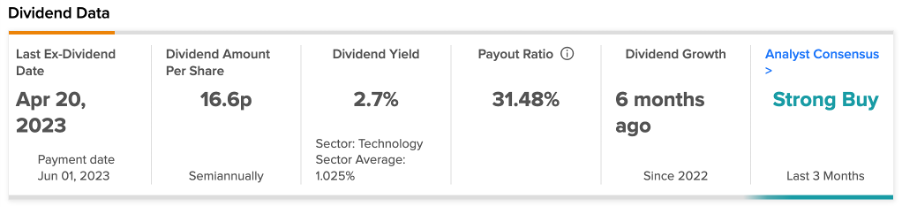

In 2022, the company increased its total dividends by 7.6% to 27.0p per share, up from 25.1p per share in 2021. This includes a final dividend of 16.6p, which will be payable on June 1, 2023. This leads to a current dividend yield of 2.7% for the company.

For 2023, analysts expect BAE to increase its dividends to 28.9p per share and further to 31.1p per share in 2024.

What is the Prediction for BAE Stock?

According to TipRanks, BA stock has a Strong Buy rating based on a total of 8 recommendations, of which six are Buy.

The average price prediction is 1,055.09p, which shows a slight change of 3.7% from the current level. The price target has a low and a high forecast of 974p and 1,146p, respectively.

Ending Thoughts

In recent years, BAE Systems has been a solid investment option for capital gains as well as dividend income. The overall outlook for the company is stable and healthy, driven by higher defense spending by governments worldwide.

BAE shares are worth holding on to for the long term, and any drop in the share price could lead to a buying opportunity for investors.