Analysts remain bullish on the share price of the FTSE 250-listed Babcock International Group PLC (GB:BAB) and predict a further upside of over 30% even after a solid year-to-date rally. Analysts are favouring the stock, considering the growing defence spending over the last few years, driven by geopolitical instability. They expect the company to register strong growth from its key customers amidst the Russia-Ukraine war and the rising tensions in the Middle East.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Babcock’s Recent Performance

Babcock published a strong half-yearly earnings report for FY24 on November 14, prompting many analysts to confirm their Buy ratings. The company delivered 18% organic revenue growth in the first half, which offset the impact of asset disposals. The underlying operating profit surpassed expectations, reaching £154.4 million, marking a substantial 27% year-on-year increase.

Management maintained its full-year projections of organic revenue growth, operating margin, and positive cash flow generation. The company also decided to start its dividend again after a gap of four years and declared an interim dividend of 1.7p per share.

Babcock International is a UK-based defence company with a global presence. The company provides engineering, support, and training services to both the defence and civilian markets. It also designs and manufactures specific product solutions for both markets.

Positive Outlook from Analysts

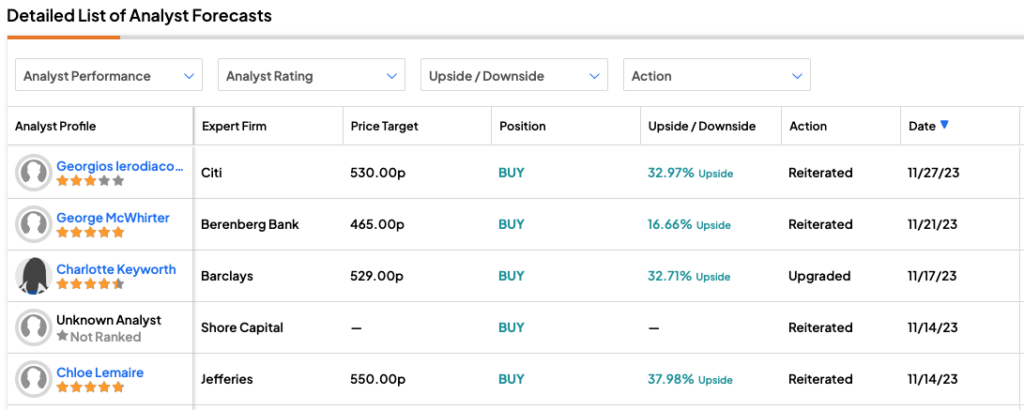

Following the half-yearly results, the stock received five Buy ratings in the last 15 days. Most recently, analyst Georgios Ierodiaconou from Citi confirmed his Buy rating on the stock, predicting an upside of 33%.

On November 17, Barclays analyst Charlotte Keyworth upgraded her rating from Hold to Buy on the stock with a similar forecast of 33% upside. Keyworth is confident in the company’s ability to generate higher cash returns for its shareholders, driven by its “portfolio streamlining, a strengthened balance sheet, and a positive free cash flow.” She also highlighted that the reinstatement of dividends will further enhance investors’ confidence in the long term.

Apart from Ierodiaconou and Keyworth, analysts from Berenberg Bank, Shore Capital, and Jefferies also maintained their Buy ratings on the stock.

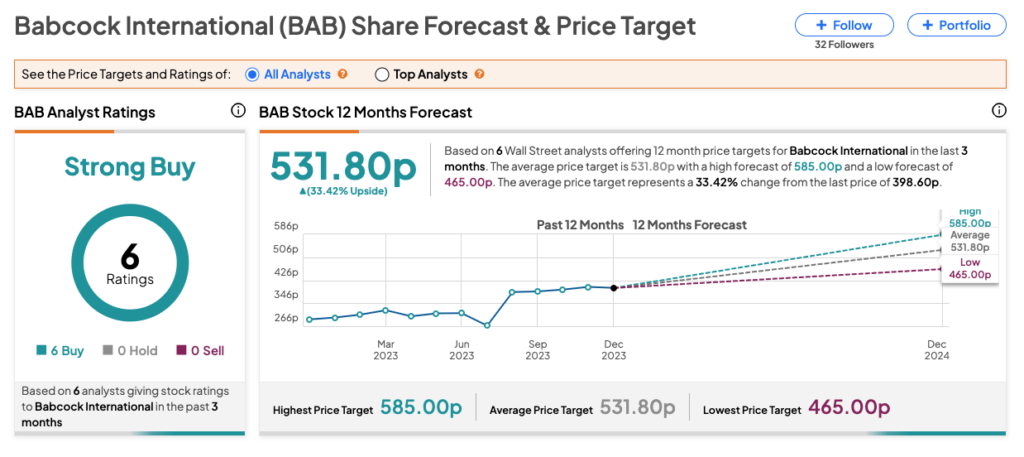

Babcock Share Price Forecast

Year-to-date, the Babcock share price has risen about 37%, picking up momentum in July following the release of its FY23 results. This came after months of underperformance, with geopolitical pressures reviving investors’ interest in the stock.

As per the consensus rating on TipRanks, BAB stock earns a Strong Buy, backed by all Buy recommendations from six analysts. The Babcock share price forecast is 531.8p, signifying a potential upside of 33.4% from the current level.