The British insurance company Aviva PLC (GB:AV) has been an attractive and popular option for investors. The stock has the potential for both capital appreciation and higher dividend income.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Over the last few years, the company has focused on its profitable offerings in its core markets, which has helped it streamline its operations. This was clearly reflected in its share prices as well. In the last three years, Aviva’s stock has grown by more than 100%.

Aviva is a leading insurance and wealth management company, offering services to around 18 million customers. The company has a diverse portfolio of products, including life and health insurance, savings, annuities, pension funds, and more.

Let’s have a look at some details.

Promising Dividends

One of the major highlights of Aviva’s shares is its dividends. The company has a dividend yield of more than 7%, which is enough to catch the attention of income investors.

In its recently reported earnings for 2022, Aviva announced a final dividend of 20.7p per share. This led to total dividends of 31p per share in 2022, which is 41% higher than the previous year’s dividend of 22.05p. The company remains focused on maintaining attractive dividends and is targeting a cash cost of around £915 million in 2023, up from £870 million in 2022.

During the year, the company also launched a share buyback of £300, which brings its total return to £5 billion since 2021. The higher shareholder returns depict the company’s strong capital position.

TipRanks Smart Score

Aviva has an outperforming score of nine on the TipRanks Smart Score tool. This score implies that the stock is more likely to surpass the overall market return.

This score is assigned after analyzing the stock on various parameters like analysts’ ratings, insider transactions, technical analysis, etc.

Analysts’ Opinion

Analysts have mixed opinions of Buy and Hold ratings on Aviva’s stock. Recently, analyst Mandeep Jagpal from RBC Capital reiterated his Buy rating on the stock. His price target of 530p implies an upside of more than 25% from the current price.

Jagpal is bullish on the stock after the strong results in 2022, including a longevity benefit of £537 million due to a change in life expectancy. He said, “We expect it will take 5 years for Aviva to introduce the 2025 [mortality] model, so we expect 5 years of longevity releases.”

Aviva Share Price Forecast

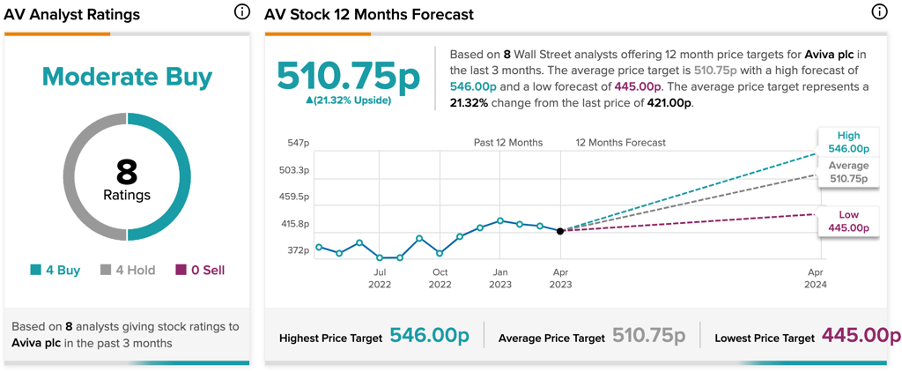

According to TipRanks consensus, AV stock has a Moderate Buy rating. This is based on four Buy and four Hold recommendations.

At an average price target of 510.75p, analysts predict an upside of 21.3% in the share price for the next 12 months.

The Takeaway

Analysts feel the demand for insurance will be strong, and the size of the market will increase further in the long term.

Aviva’s long and successful history in the insurance business puts it right in the middle of this growth. Overall, the company is well-positioned with its diversified offerings across different markets, solid balance sheet, and confidence from analysts.