Aviva PLC (GB:AV), the leading British insurance company on the FTSE 100 index, has significant appeal among investors. The stock satisfies the criteria for both capital appreciation and dividend income, making it an enticing choice.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

According to analysts, the stock is rated a Strong Buy despite starting this year in the red zone. The shares are currently trading down from their high point last year due to headwinds from higher inflation and the deteriorating economic conditions in Western markets. The shares are trading down by 8.5% so far in 2023.

As a prominent insurance and wealth management company, Aviva offers a diverse portfolio of products, including life and health insurance, savings accounts, annuities, pension funds, and various other financial services.

The Bullish Case

In its Q1 2023 trading update, the company reported sustained growth momentum across the entire Group. The company’s general insurance premium grew by 11% to £2.4 billion, along with profitability in the segment. This was mainly driven by the company’s strict cost control measures and well-balanced offerings of personal and commercial insurance.

The company is making steady progress towards achieving its savings target of £750 million by 2024.

Aviva’s shares are also notably distinguished by its dividends, with the company boasting a dividend yield of 8.1%. This attractive dividend yield is likely to capture the interest of income-oriented investors.

In 2022, Aviva distributed a total dividend of 31p per share, marking a significant increase of 41% compared to the previous year’s dividend of 22.05p. The company aims to achieve a cash cost of dividends of around £915 million in 2023, up from £870 million in 2022.

Is Aviva a Good Stock to Buy Now?

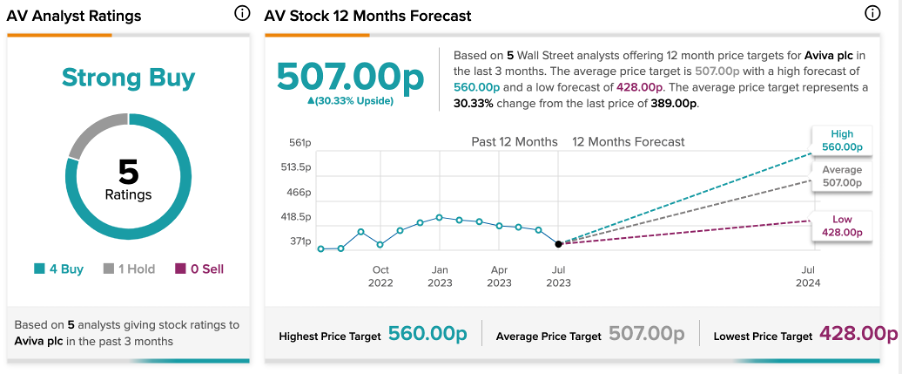

According to TipRanks consensus, AV stock has a Strong Buy rating. This is based on four Buy and one Hold recommendations.

At an average price target of 507p, analysts predict an upside of 30.3% in the share price for the next 12 months. The price has a high forecast of 560p and a low forecast of 428p.

Conclusion

Aviva is uniquely positioned to navigate the current economic landscape with success. With financial strength, an appealing dividend, and a Strong Buy rating from analysts, investors could consider the stock for long-term returns.