The FTSE 100-listed company, Aviva Plc (GB:AV), could be a good addition to your portfolio as a dividend stock. Aviva offers a lucrative dividend yield of 7.54%, significantly higher than its peers. Aviva is a London-based multinational insurance company.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

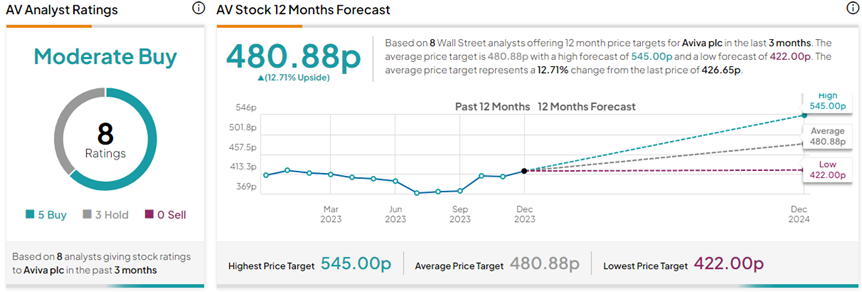

Its operations span the U.K., Ireland, and Canada, boasting 18 million customers. In Britain, Aviva is the largest general insurance provider and a leading life and pension provider. Importantly, analysts have rated AV stock a Moderate Buy with a potential share price appreciation of nearly 13% in the next twelve months.

TipRanks provides a range of tools to assist users in identifying suitable dividend stocks that align with their preferences. Here, we used the TipRanks’ Top Dividend Shares tool for the UK market to identify Aviva stock. This tool simplifies the stock selection process, making it more efficient for users seeking specific dividend investments.

Aviva Supports a Strong Dividend Policy

Aviva’s most recent dividend of 11.1p per share, up 8% year-over-year, was paid on October 5, 2023. In 2022, the insurance giant gave out a detailed plan for increasing shareholder dividends for 2 years up to 2024. As per the policy, for the full year 2023, Aviva is expected to pay a total annual dividend of 33.4p per share. Thereafter, the company expects the “cash cost of the dividend” to grow by low to mid-single digits.

Aviva has been outperforming earnings expectations in the last three semi-annual results. Looking ahead, the company continues to command pricing power in its general insurance business. Meanwhile, in the wealth & retirement segment, Aviva is expected to witness continued overall growth.

Is Aviva a Hold or Sell?

On TipRanks, AV stock has a Moderate Buy consensus rating based on five Buys versus three Hold ratings. The Aviva Plc share price target of 480.88p implies 12.7% upside potential from current levels. Year-to-date, AV shares have gained 2.9%.