In today’s article, we will dive into the potential of two UK stocks, Aviva PLC (GB:AV) and Legal & General Group PLC (GB:LGEN), which boast dividend yields exceeding 8%. Both of these stocks are scheduled to reach their ex-dividends this week. This implies that to qualify for their upcoming dividend payment, investors need to purchase these stocks before their ex-dividend dates.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In addition to offering appealing dividends, both stocks have received Moderate Buy ratings from analysts, indicating the possibility of further growth potential.

Here, we have used the TipRanks Top Dividend Shares tool for the UK market, which helps users screen and choose the right dividend stock. Tools like these simplify the tedious process of selecting stocks within a specific market.

Let’s take a look at these two stocks in detail.

Aviva PLC

Aviva is a leading insurance company that serves a customer base of over 11 million. It offers a range of products, including insurance, wealth management, and retirement solutions.

Recently, the company posted an impressive set of half-yearly earnings for 2023, despite inflationary pressures in the economy. The company posted an increase of 8% in its profits in the first half, and it anticipates surpassing its current expectations in its full-year performance. The operating profits also grew by 8% to £761 million.

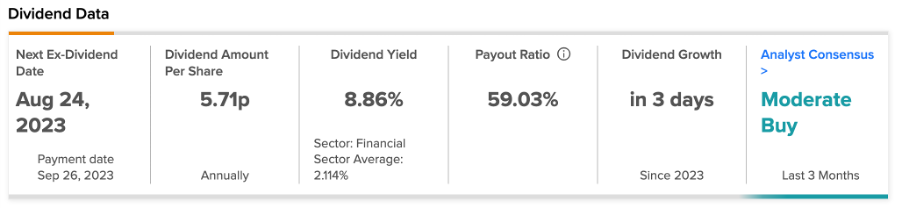

Sitting on a solid cash position, the company increased its dividend by 8% to 11.1p per share, bringing the dividend yield to 8.1%. The company mentioned that it foresees continuous and sustainable capital returns in the future.

The company has also indicated that it anticipates achieving its goal of reducing £750 million in gross costs one year ahead of schedule. The company’s costs remained steady at £1.3 billion in the first half of 2023. The company’s shares are down by 10.5% this year, presenting a favorable opportunity for investors due to its inflation-beating dividend and its capacity to manage higher costs.

Aviva Share Price Prediction

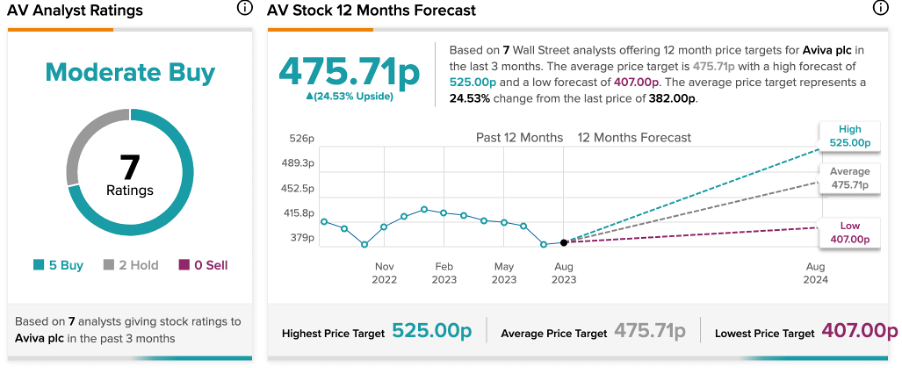

According to TipRanks, AV stock has received a Moderate Buy rating based on a total of seven recommendations. It includes five Buy and two Hold ratings from analysts.

The average price forecast is 475.7p with a high forecast of 525p and a low forecast of 407p. The price target implies an upside of 24.5% on the current trading levels.

Legal & General Group PLC

Legal & General Group is a UK-based financial services company that provides insurance, wealth management, savings, and investment products.

The company’s next ex-dividend date is August 24 for the interim dividend for 2023. The company announced an interim dividend of 5.71p per share, hiking it by 5% over the previous year’s interim payment of 5.4p. The current dividend yield is 8.86%. This aligns with the company’s long-term plan to sustain 5% annual dividend growth in its dividends until 2024.

Last week, the company also reported its half-year earnings for 2023 ahead of market expectations. It posted an operating profit of £941 million, above the estimate of £834 million. The solvency coverage ratio, which is a significant indicator of balance sheet strength, reached 230%, higher than last year’s 212%. The company also reported steady progress in attaining its targets set for the period from 2020 to 2024.

Is Legal and General Stock a Good Buy?

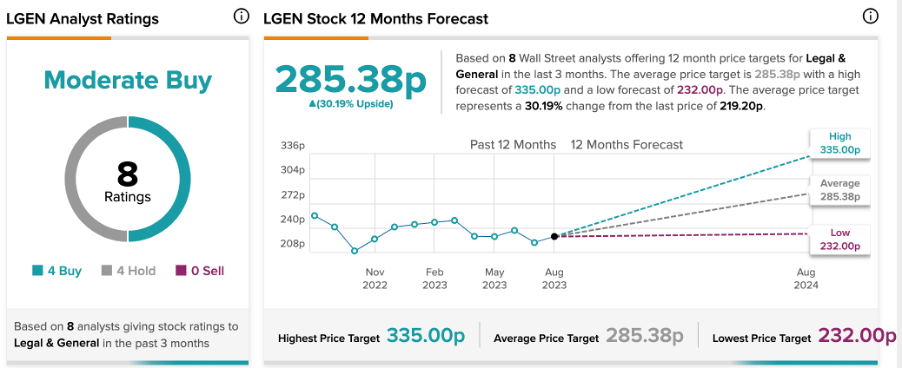

LGEN stock has a Moderate Buy rating on TipRanks, backed by four Buy and four Hold recommendations. The average price prediction is 285.38p, which is 30.2% higher than the current price level.

Conclusion

Both LGEN and AV are delivering consistent returns to investors, which has been further backed by their strong numbers reported recently. The Buy ratings from analysts add to the appeal of these stocks.