In the key news on Australian stocks, Lynas Rare Earths Limited (AU:LYC) soared after billionaire Gina Rinehart grabbed a big stake in the company. According to an exchange filing by Lynas, Rinehart through her private company, Hancock Prospecting Ltd., became a substantial shareholder with a 5.82% stake, holding a total of 54.4 million shares. Lynas shares gained 6% in today’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lynas Rare Earths is a producer of rare earth minerals outside of China, primarily in Australia and Malaysia.

Breakdown of Rinehart’s Investment in Lynas

Yesterday, Rinehart and Hancock acquired 6.6 million Lynas Rare Earths shares for slightly over AU$40 million. Hancock has been consistently buying the company’s stock since last December. After a brief pause, Rinehart acquired AU$49 million worth of shares in April over three trading days.

Rinehart investment in Lynas has sparked potential consolidation within the rare earths sector. Earlier this month, Hancock acquired a significant stake in the U.S.-based rare earth element producer MP Materials (NYSE:MP). Lynas was in talks with MP Materials regarding a potential merger, which ultimately did not materialize. Analysts at Canaccord Genuity believe that Rinehart, as a significant shareholder in both companies, could be seeking to revive the possibility of a merger.

Is Lynas Stock a Good Buy?

In the first half of FY24, Lynas Rare Earths numbers were impacted by weaker demand in China amid a slowdown in the construction sector. Revenues declined by 36.5%, while profits fell 74% year-over-year, primarily due to falling rare earth prices. Nonetheless, analysts believe the demand for rare earth elements will outstrip supply in 2026, potentially driving their prices higher as early as next year.

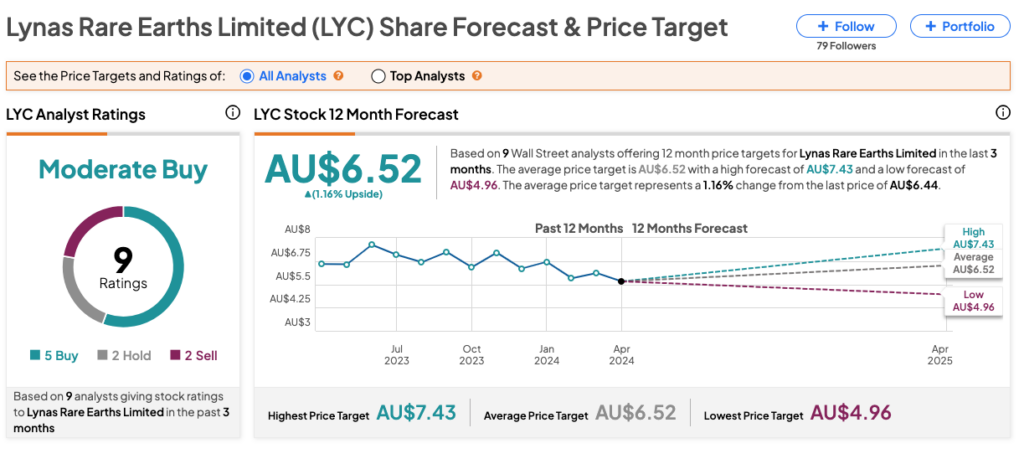

According to TipRanks consensus, LYC stock has been rated a Moderate Buy, backed by five Buy, two Hold, and two Sell recommendations. The Lynas share price forecast is AU$6.52, which implies a growth rate of 1.16% from the current level.