In key news on Australian stocks, Premier Investments Limited (AU:PMV) shares gained sharply after the company revealed demerger plans and separate listings for its Smiggle and Peter Alexander brands while announcing its first-half results for FY24. The company reported a nearly 1.7% increase in half-year statutory net profit to AU$177.2 million.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

In response, shares surged 9.3% to reach an all-time high of AU$33.51 before retracing some gains. PMV stock was up 4% as of writing.

Premier Investments owns and manages a range of retail and wholesale enterprises across Australia, New Zealand, Singapore, and the UK.

Highlights from the H1 FY24 Results

Premier Retail’s global sales totalled $879.5 million, down 2.8% from H1 FY23, but still 20.1% higher than pre-COVID levels in H1 FY20. Among its businesses, Peter Alexander excelled with record sales of AU$279.3 million, up 6.7% from last year. However, Smiggle’s global sales declined 3.6% to AU$183.9 million, reflecting the impact of cost-of-living pressures worldwide.

Additionally, the company declared an interim dividend of AU$0.63 per share, which was 16.7% higher than the corresponding period last year.

Potential Demerger in Focus

The major highlight of Premier Investments’ results was the announcement of its demerger plans for the stationary brand Smiggle and designer sleepwear brand Peter Alexander. The company is eyeing a demerger of Smiggle by the end of January 2025, followed by Peter Alexander in the calendar year 2025. The demerger is part of the company’s strategic review, aiming at better growth prospects for these brands in the long term.

Commenting on the demerger plans, Citi analyst James Wang highlighted the challenges of securing suitable rental contracts with three separate entities. That said, he believes that the “market is under-appreciating the roll-out potential for both brands.”

Is PMV a Good Investment?

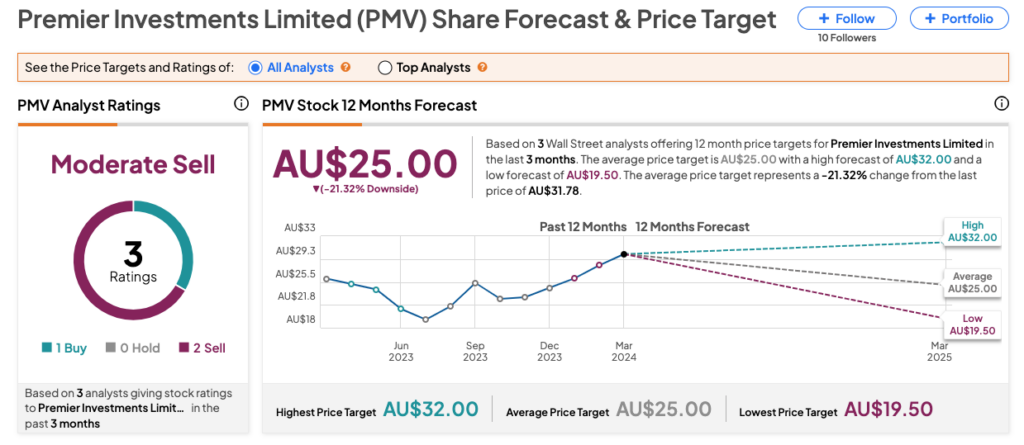

On TipRanks, PMV stock has received a Moderate Sell consensus rating based on one Buy and two Sell recommendations. The Premier Investments share price target is AU$25, which is 21.3% below the current trading level.