In key news on Australian stocks, shares of Flight Centre Travel Group Limited (AU:FLT) declined about 4% today, despite the company posting stellar growth in profits. In H1 FY2024, the company reported a 565% surge in its underlying profit before tax (PBT) to AU$106 million, up from $16 million in the previous year’s comparable period. However, shares fell as the bottom line failed to meet analysts’ high expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Flight Centre is a global leisure company serving both retail and corporate travel sectors, with operations spanning 24 countries.

What’s Happening to FLT Shares?

Despite the huge surge in profits, FLT shares moved in the opposite direction due to investors’ and analysts’ elevated expectations. Moreover, the company cautioned that the upcoming months will be critical for achieving the stated guidance.

Analyst Wei-Weng Chen from RBC Capital Markets believes the numbers were “weaker than expected,” especially when considering amortization costs. He added that the company’s higher expectations for the second half could lead to a guidance downgrade later in the year.

Highlights of the Results

Flight Centre experienced a 15% increase in total transaction value (TTV) in the first half of FY24, reaching AU$11.3 billion, marking a robust start to the Fiscal Year. Among the segments, corporate TTV grew by 16.8%, while leisure TTV increased by 18%. The company’s revenue margin grew by 130 basis points to 11.4%.

Driven by positive performance, the company reinstated its interim dividend after its last payment in 2019. For the first half, it announced an interim dividend of AU$0.10 per share.

Speaking of the FY24 outlook, Flight Centre expects an underlying PBT between $300 million and $340 million for FY24, reflecting an increase from the previous forecast range of $270 million to $310 million.

Is Flight Centre a Good Buy?

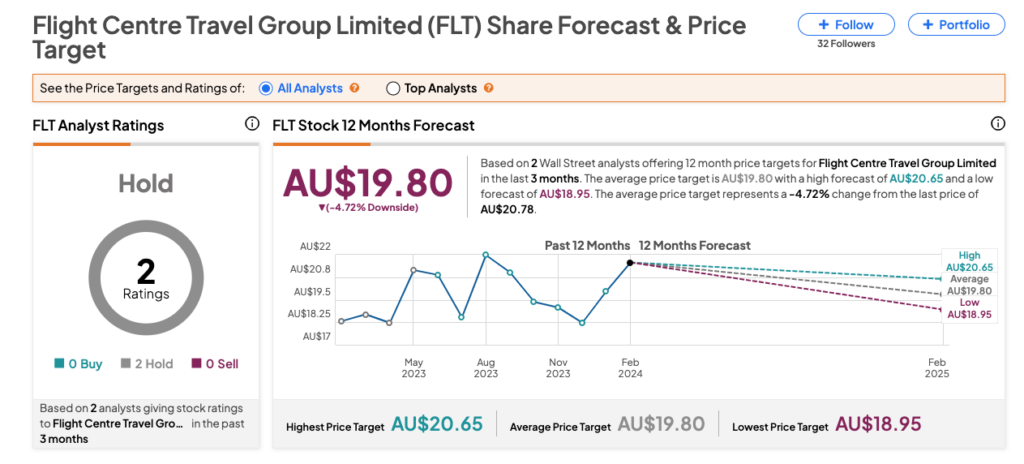

Following the results, analyst Samuel Seow from Citi reiterated a Buy rating on the stock, predicting an increase of 13.8%. Meanwhile, UBS analyst Tim Plumbe confirmed a Hold rating with a forecast of 11% growth in share price.

According to TipRanks, FLT stock has a Hold consensus rating. The Flight Centre share price forecast is AU$19.80, which is 4.7% below the current trading levels.