Atos SE (FR:ATO) shares plummeted over 10% today after the France-based company issued a cash flow warning and announced the appointment of a new CEO. The company stated that its cash flow for the second half of FY23 will fall short of its target by €100 million. ATO shares were trading down by almost 12% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The stock started this year on a troubled note and has lost 39% of its value year-to-date. Atos shares were hit hard in early January after the company confirmed early-stage discussions to sell its big data and cybersecurity business to Airbus SE (FR:AIR).

Based in France, Atos provides consulting, technology services, cloud and infrastructure, digital platforms, and other IT services.

The Struggle Continues

Atos named Paul Saleh as the new CEO, succeeding Yves Bernaert, with immediate effect. Saleh joined the company in August 2023 as the chief financial officer. This marks the company’s fourth CEO within a span of two years as it struggles with profit warnings and restructuring efforts.

This decision comes in the wake of a disagreement between the board and Bernaert regarding a turnaround strategy for the company. Bernaert joined Atos in October 2023 to lead the company’s turnaround, including refinancing. However, he opted to exit the company, citing “a difference of opinion on the governance to adjust and execute the strategy.”

Meanwhile, the company confirmed that it is on track to meet the full-year financial targets for revenue and profits. The company will announce its full-year results for 2023 on February 29, 2024.

Is Atos a Buy or Sell?

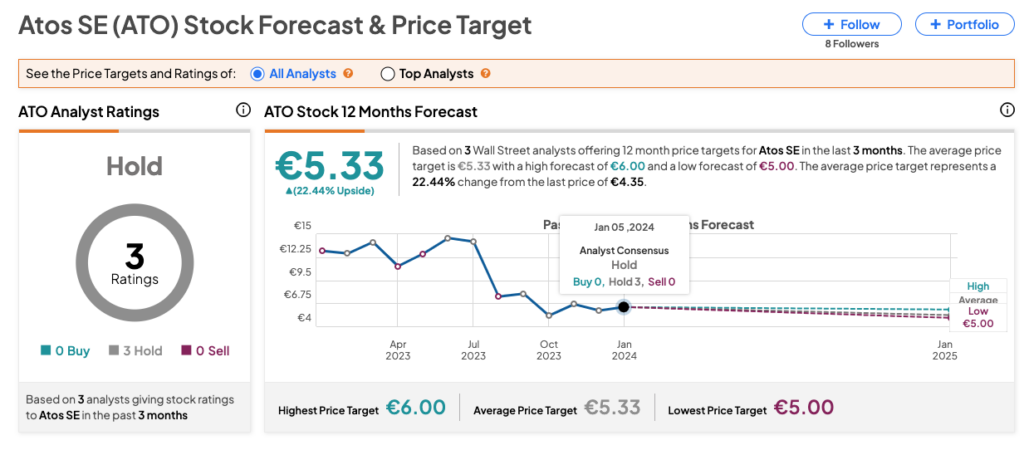

According to TipRanks, ATO stock has received a Hold consensus rating based on three Hold recommendations. The Atos share price target is €5.33, which is 22.4% above the current trading levels.

The ratings were last updated in October 2023 and are subject to change accordingly.