ASX-listed companies BHP Group (AU:BHP), ANZ Group Holdings (AU:ANZ), and National Australia Bank Limited (AU:NAB) are popular dividend stocks. Shares of these companies offer attractive yields, making them a viable investment option for investors seeking passive income within their portfolios.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at these companies in detail.

Is BHP a Good Stock to Buy?

BHP operates as a global resources company engaged in the mining of iron ore, copper, coal, silver, nickel, and other minerals. Despite global macro concerns and slowing growth in the U.S., Japan, and Europe, BHP continues to deliver strong financial and operating performance. This growth reflects an economic rebound in China and solid momentum in India.

Thanks to the strength in its business, BHP announced an interim dividend of US$0.90 per share. Furthermore, it offers an attractive yield of over 9%.

BHP is well-positioned to enhance its shareholders’ return through regular dividend payments. The positive demand outlook for commodities in China and India, lower production costs, and productivity and costs savings position it well to deliver solid financials and will drive its payouts.

While the company’s dividend profile attracts, analysts remain sidelined on BHP stock due to the slowing growth in the U.S., Europe, and Japan. It has a Hold consensus rating on TipRanks based on six Buy, 10 Hold, and two Sell recommendations. The analysts’ average price target of AU$45.31 is 3.26% higher than the current price level.

Is ANZ a Good Investment?

Australia and New Zealand Banking Group is among the leading banking institutions in Australia. The bank benefits from its diversified revenue base, growing loans and deposits base, stable credit performance, focus on cost savings, and strong balance sheet. Further, ANZ is one of the most well-capitalized banks in the world.

ANZ Group announced an interim dividend of AU$0.81 per share and offers a high yield of over 6.6%.

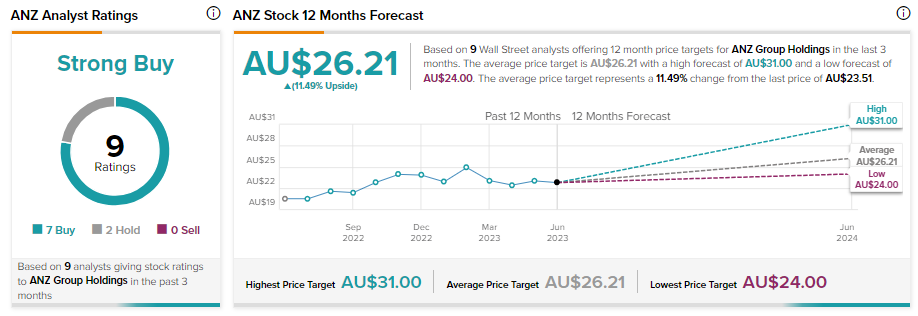

ANZ stock sports a Strong Buy consensus rating, reflecting seven Buy and two Hold recommendations. Further, analysts’ average price target of AU$26.21 is 11.49% higher than its current market price.

What is the Future of NAB Share Price?

National Australia Bank is among the top-tier banks in Australia. Its ability to generate strong underlying profits led by volumes and higher margins positions it well to enhance its shareholders’ returns via reliable dividend payouts.

Its diversified revenues, investments in long-term growth opportunities, and solid balance sheet augur well for growth. Moreover, in the near-term, higher interest rates will support its financial performance.

The bank announced an interim dividend of AU$0.83 per share, translating into a yield of 6.25%.

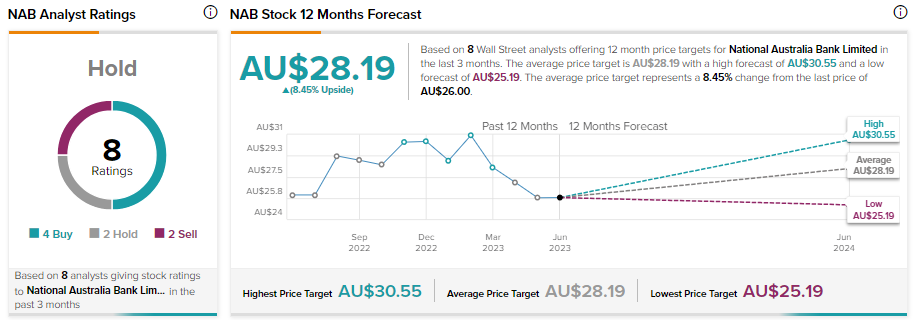

NAB stock has received four Buy, two Hold, and two Sell recommendations for a Hold consensus rating o TipRanks. Analysts’ 12-month average price target of AU$28.19 is 8.45% higher than its current price level.

Bottom Line

The diversified revenue base, strong fundamentals, and ability to generate attractive underlying profits enable these Australian companies to enhance their shareholders’ returns via regular dividend payouts. Further, investors can leverage the TipRanks Top Dividend Stocks tool to find attractive stocks from Australia.