FTSE 100-listed Associated British Foods plc (GB:ABF) provided its Fiscal first quarter trading update, including the Christmas season performance, this morning. ABF shares initially rose to 2.3% in early trade and have since been volatile as investors digest the full story. For the 16 weeks ending January 6, 2024, ABF’s revenue grew 5.4% to £6.89 billion. Meanwhile, its fashion-first retail chain Primark witnessed only a 2.1% rise in like-for-like sales, far lower than the 8% growth registered in the earlier quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

London-based Associated British Foods is a multinational food processing and retailing company that owns the renowned brands Primark and Twinings. ABF shares have gained over 22% in the past year.

More About Primark’s Performance

AB Foods’ major revenue contributor, Primark’s Q1 FY24 sales grew 7.9%. Meanwhile, sales from the company’s Sugar business jumped 13% (at constant currency), but Agriculture business declined 10.8%.

In the 12 weeks running up to December 10, Primark’s market share grew 0.1 percentage point year-over-year to 7.1%. Going ahead, AB Foods is confident in Primark’s adjusted operating margin improvement, aided by improving product gross margins. The company said that this could help to protect it against any potential Red Sea disruption and supply chain issues.

Primark’s Q1 FY24 performance was affected by the unseasonal weather earlier in the quarter. Even the 2.1% growth in like-for-like sales was due to higher average selling prices and not because of any significant increase in volumes.

Overall, AB Foods hopes for notable progress in 2024, both in terms of profitability and cash generation. AB Foods expects that a recovery in Primark’s margin, British Sugar’s profitability, and reduced losses at Vivergo Fuels will bring in better days in 2024.

What is the Price Target for ABF?

Following the Q1 FY24 update, Goldman Sachs analyst Richard Edwards reiterated a Hold rating on ABF stock without assigning a price target. The analyst thinks that Primark’s like-for-like sales miss was offset by “more confident” gross margin guidance.

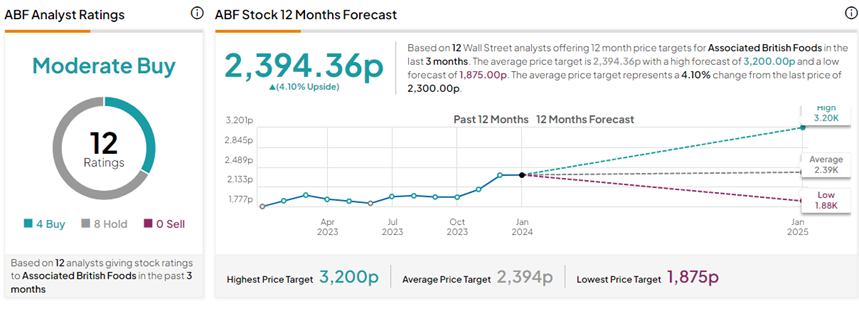

Overall, analysts are split on AB Foods’ stock trajectory. On TipRanks, ABF stock has a Moderate Buy consensus rating based on four Buys versus eight Hold recommendations. The Associated British Foods share price forecast of 2,394.36p implies 4.1% upside potential from current levels.