The Netherlands-based manufacturer ASML Holding NV (NASDAQ:ASML) (DE:ASME) reported its third-quarter earnings today, disclosing strong profits of €1.9 billion. The company signalled that its sales in 2024 would remain flat due to lower expected demand in the semiconductor industry. The company expects 2024 to be its “transition year,” as it remains uncertain about the recovery in product demand in the industry. Therefore, it foresees its sales in 2024 to be similar to the levels of 2023 but sees growth in 2025.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

ASML is among the crucial players in the semiconductor industry globally. The company is known for its lithography machines, which are essential for manufacturing the most advanced chips in the world.

Q3 2023 Results

The company reported sales of €6.7 billion in the third quarter, as compared to €6.9 billion in the same quarter a year ago. The gross margin stood at 51.9%, slightly above the 51.3% reported last year. The sales were mainly driven by its DUV lithography products. ASML anticipates net sales in the range of €6.7 billion to €7.1 billion and a gross margin between 50% and 51% for the fourth quarter of 2023. For the full year 2023, the company is looking at 30% growth in its net sales with a small improvement in gross margins as compared to 2022.

The quarterly net bookings for Q3 were €2.6 billion, down from €4.5 billion in the corresponding period last year. The company stated that its customers are very cautious with cash and capital expenditure, leading to lower orders for the company.

Is ASML a Good Share to Buy?

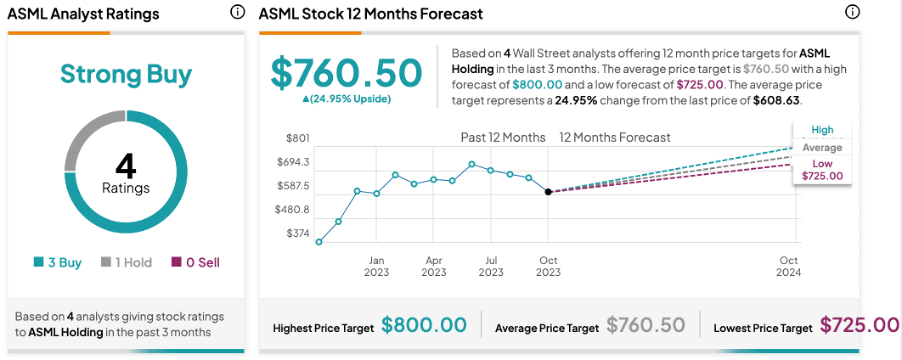

According to TipRanks’ consensus, ASML stock has received a Strong Buy rating based on a total of four recommendations from analysts. It includes three Buy and one Hold ratings. The ASML share price forecast is $760.5, which is 25% above the current trading levels.