German companies Commerzbank (DE:CBK) and Delivery Hero (DE:DHER) have been trending in the market after gaining analyst confidence in the last few days.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Both Commerzbank and Delivery Hero have declared growth-oriented results, which has helped them regain analysts’ confidence. The analysts are bullish on these companies and have also predicted an upside in their share prices.

Following an analyst’s recommendation is a tried-and-true method for selecting stocks in any market. The TipRanks Trending Stocks tool, which is available for seven different markets, is one of the simplest ways to find such stocks. This tool provides an updated list of stocks that have recently seen any action in their ratings from analysts. This is an easy way to choose stocks for any further research on investing.

Let’s have a look at these companies in detail.

Commerzbank AG

Commerzbank is a German bank that provides a broad range of financial services through its branches and offices in 50 countries.

Analysts remain bullish on the stock based on its strong performance in 2022 and a positive outlook laid out by the bank for 2023. The bank expects higher net interest margins for 2023, despite a challenging environment.

Last week, the bank announced its 2022 annual results, which showed higher revenue growth as well better cost efficiency. The bank’s revenue increased by 12% to €9.5 billion from higher customer activities and rising interest rates. For the year, the bank posted a net profit of €1.435 billion, which was more than three times the profit of €430 million in 2021. This also beat analysts’ expectations of €1.36 billion.

The net interest income jumped by 33% to €6.5 billion. Moving forward, the bank expects it to be even higher in 2023, further increasing its profitability.

The bank announced a dividend of €0.2 per share for 2022.

What is Commerzbank’s Target Price?

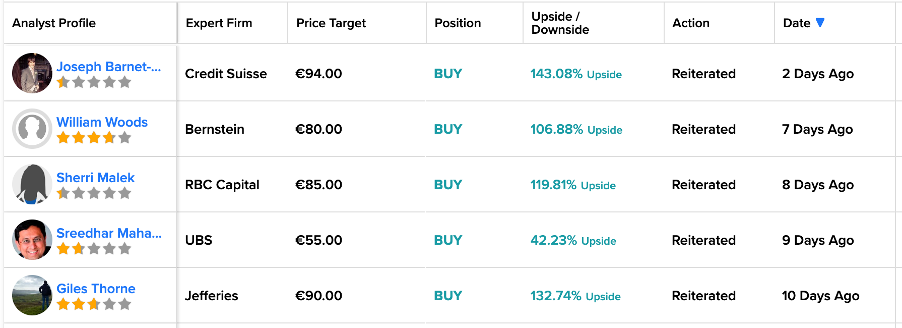

Post-results, the stock has seen a lot of action from analysts. Recently, analysts from Morgan Stanley and UBS have reiterated their Buy ratings.

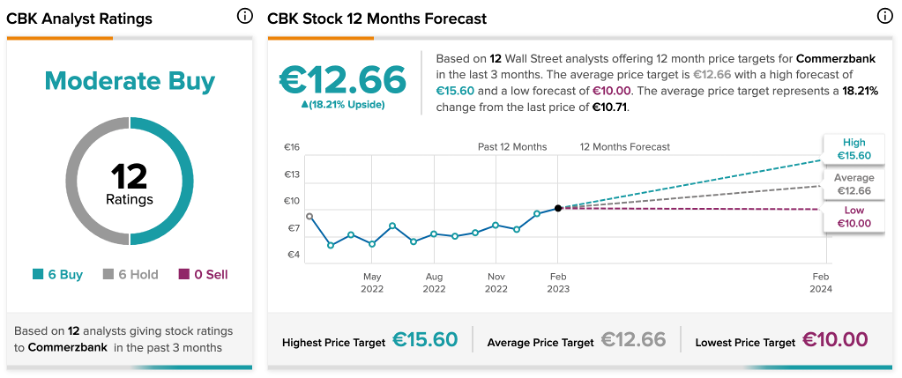

Overall, CBK stock has a Moderate Buy rating, based on six Buy and six Hold recommendations.

The average target price is €12.66, suggesting an upside of 18.21% from the current price.

Delivery Hero SE

Delivery Hero is an online food delivery platform, with a presence in more than 70 countries.

The company’s stock has been trading down by 12.6% in the last year. The company was also a victim of COVID-affected businesses, which posed numerous challenges to the industry as a whole.

In February, the company announced its Q4 results for 2022, which clearly showed its progress toward profitability. The GMV (gross merchandise value) increased by 9% to €11.4 billion in the quarter. The company ended 2022 with a cash balance of €2.4 billion, which will help reduce the cash burn in the coming quarters.

The company’s margins are constantly improving, and it confirmed the guidance of its EBITDA/GMV margin of over 1% for the first half of 2023.

Delivery Hero Stock Forecast

After the announcement of the result, analysts are highly bullish on the stock and also see a huge upside in the share price.

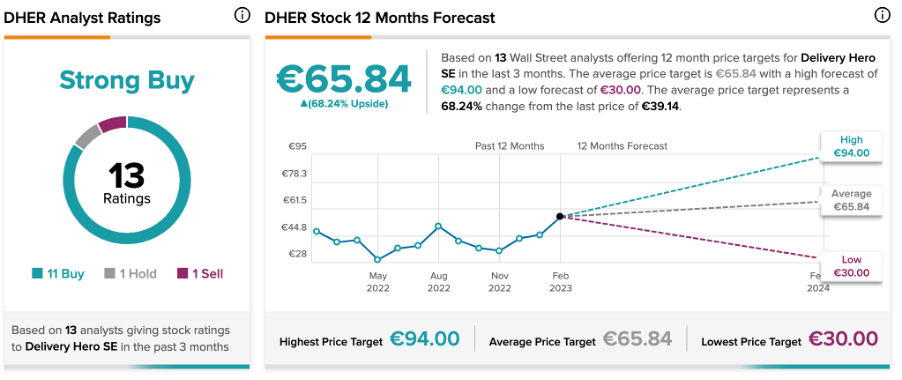

According to TipRanks consensus, DHER stock has a Strong Buy rating, based on 11 Buy, one Hold, and one Sell recommendations.

The average target price is €65.84, which has a huge upside potential of 68.24%.

Conclusion

Analysts think Delivery Hero has huge upside potential, driven by a recovery in its operations and profits. The decline in the share price provides a good buying opportunity.

While Commerzbank stock is already performing well, analysts still see an upside of around 18% on the share price. The higher net interest income will drive more profits for the bank in 2023.