German companies Allianz SE (DE:ALV) and BASF SE (DE:BAS) have a dividend yield of more than 5%. They also surpass their respective sector averages with their growing dividends.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

When compared to each other, Allianz is in a more stable position to maintain its dividend growth in the future. On the other hand, BASF is facing pressure from rising costs on its earnings, which could impact its dividends.

When picking the right dividend stocks, there are many tools on TipRanks that can guide the user. Dividend Stocks, Dividend Calculators, Dividend Calendars, and Stocks Comparisons are some of the tools that make investors’ work easier when screening and comparing different stocks within a particular market.

When screening and comparing various stocks within a given market, investors can find it easier to use tools like dividend stocks, dividend calculators, dividend calendars, and stock comparisons.

Let’s see the two stocks in detail.

Allianz SE

Allianz is a financial services company based in Germany. The company has a huge customer base of 122 million customers in around 70 countries worldwide.

The company has dominance over the insurance market in Germany, which gives stability to its revenues and profitability. In its Q4 2022 earnings, the company’s operating profit was up 12.7% to €4 billion. Moving forward, the company is targeting a yearly operating profit of €14.2 billion based on stronger operations in 2023.

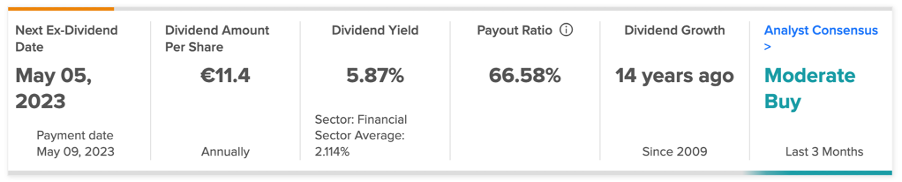

Over the last 15 years, the company’s annual dividend has increased at a CAGR of 9% and is targeting a rate of 5% in the future. Currently, the company’s dividend yield is 5.86%. For 2022, the company will recommend a dividend of €11.4 per share, indicating a growth of 5.6% from the previous year.

To manage healthy shareholder returns, the company has a policy of paying out 50% of its net income. The company also has a buyback program for €1 billion to be completed by December 2023.

Allianz Share Price Forecast

According to TipRanks, ALV stock has a Moderate Buy rating. The stock has a total of 10 recommendations, out of which seven are Buy.

The average price forecast for Allianz is €251.9, which shows an upside of 21.6% from the current price.

BASF SE

BASF is among the largest chemical manufacturers in the world. The company caters to various industries, such as electronics, agriculture, construction, energy, etc.

The company is also a part of the DivDAX share index, which comprises the top 15 high-dividend yield companies in the DAX 40.

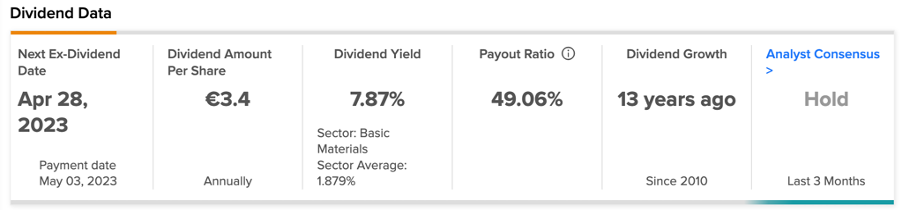

BASF will propose a dividend of €3.4 per share for 2022, which is similar to the previous year’s payments. With this payment, the company’s dividend yield will be 7.3%.

On the flip side, last month, the company announced around 2,600 job cuts to streamline its rising costs, which will hit its earnings in 2023. As part of this, the company also reduced its share buyback program from €3 billion to €1.4 billion.

Analysts feel future dividend payments also come under the scanner and will depend on its future cash flow situation.

Is BASF a Good Stock to Buy?

BAS stock has a Hold rating, based on a total of 14 recommendations on TipRanks.

The target price is €54.62, which is 18% higher than the current price level.

Conclusion

Among these two German companies, BASF has a dividend yield of 7.6%, while Allianz has 5.4%. However, in terms of total payment, Allianz stands ahead with higher dividends in 2022.

Allianz is well-positioned to maintain growth in its dividends in the future based on its profit recovery in 2022. The company also has a stronger outlook for 2023.

As for BASF, the company is having a tough time controlling its costs to safeguard its earnings in 2023.