Shares of ASX-listed Alumina Limited (AU:AWC) gained 8.8% today on news of the Western Australian (WA) government granting approval to Alcoa World Alumina and Chemicals (AWAC) to continue bauxite mining and downstream alumina refining in the state. AWAC is a joint venture between Alumina (40% ownership) and American mining giant Alcoa (NYSE:AA).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

AWAC Gains Government Approval

Alumina’s sole investment and only mining operations are through AWAC, which was formed decades back in 1994. Importantly, the WA has approved AWAC’s recent five-year (2023-2027) mine plan for its Huntly and Willowdale bauxite mines. Moreover, the WA has given exemptions to AWAC to continue mining, subject to approval from the WA Environmental Protection Authority (EPA). The EPA will check several environmental parameters, such as the protection of drinking water and accelerated forest restoration, among others. The EPA is expected to inspect all parts of AWAC’s five-year Mining and Management Program (MMP) and give its decision by year-end.

AWAC noted that its Q4FY23 business has been performing well based on the results of the first two months of the quarter. Declining production costs have helped keep the cash flows positive thus far. Going ahead, AWAC is seeking approval to mine in new areas of Myara North and Holyoake (no earlier than 2027), subject to the WA’s approval. These two new sites promise higher grades of bauxite than the reduced grade bauxite mined currently.

Is Alumina a Good Stock?

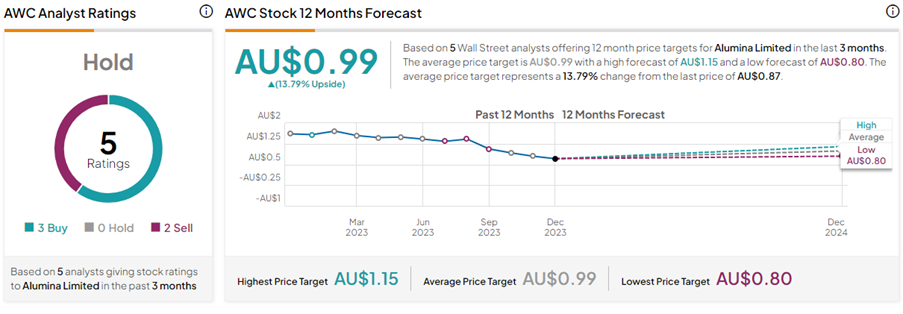

On TipRanks, AWC stock has a Hold consensus rating based on three Buys versus two Sell ratings. The Alumina Limited share price target of AU$0.99 implies 13.8% upside potential from current levels. Year-to-date, AWC shares have lost 42.8%.