Shares of air carrier Air France KLM (FR:AF) are diving down 6.2% as of writing following the news of a rating downgrade by J.P. Morgan. In a report reviewing the European airline industry, analyst Sam Bland downgraded the AF-KLM stock to a Sell rating from a Buy, saying that he prefers low-cost carriers over network airlines due to potential profitability concerns. Moreover, Bland slashed the price target for AF stock to €9.50 from €21.50, implying a 21% downside potential from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reasons for the Rating Downgrade

The major reasons for the rating downgrade include increasing jet fuel prices, lowered profit expectations for Fiscal 2024, and concerns over capacity increases that are expected to pressure unit revenue growth.

The analyst stated that maintaining unit revenue growth across the Transatlantic line is particularly troubling. For Air France KLM, Bland forecasts unit revenue to drop 3.5% annually in 2024 due to higher capacity growth. Additionally, he expects average fares across Europe and North American regions to drop drastically year-over-year.

Is Air France KLM a Good Stock?

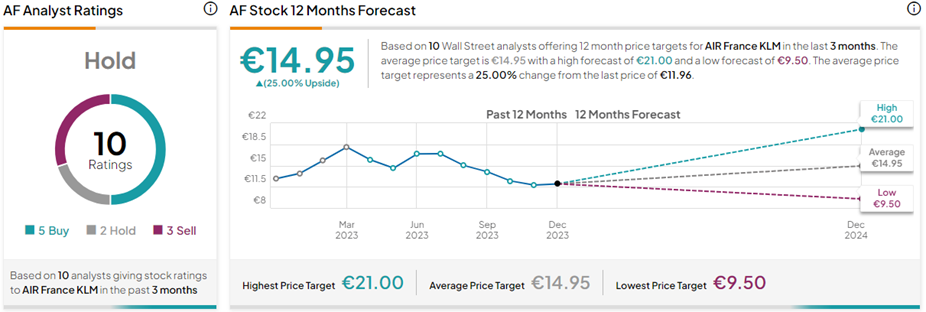

On TipRanks, AF stock has a Hold consensus rating based on five Buys, two Holds, and three Sell ratings. The Air France KLM share price forecast of €14.95 implies 25% upside potential from current levels.