Pharmaceutical giants GlaxoSmithKline (GB:GSK) and AstraZeneca (GB:AZN) are set to report their Q4 and full-year earnings for 2022. Analysts are a little sceptical about GSK’s long-term vision and await new updates on its R&D. Meanwhile, AZN is well-positioned for the future with strong sales growth and approved drugs in its portfolio.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The TipRanks Earnings Calendar tool is a perfect guide for investors to check the date-wise calendar for the upcoming earnings session. This tool is available for different markets, and it lists the companies that are set to release their results on any particular date.

Let’s have a look at the details.

GlaxoSmithKline Plc

GlaxoSmithKline is a British pharmaceutical company engaged in the development of vaccines and specialty medicines to treat multiple diseases.

The company is set to announce its fourth quarter and full-year earnings for 2022 on Wednesday, February 1, 2023. The consensus forecast for EPS is 0.23p for the fourth quarter, as compared to 0.26p in the same quarter a year ago.

The company has achieved and even surpassed its guidance numbers for the first three quarters of 2022. Shareholders expect a similarly strong performance, driven by higher investment in R&D. Analysts also expect a stronger push from its vaccines division, with Shingrix, one of its best-sellers, expected to post double-digit growth in full-year results.

For its full year 2022, the company expects its sales to increase by 8% to 10% and operating profit to grow by 15% to 17%. The company also expects a favourable foreign exchange impact of 6% on 2022 sales. In 2021, sales grew by 5% at a constant exchange rate, but operating profit was down by 9%.

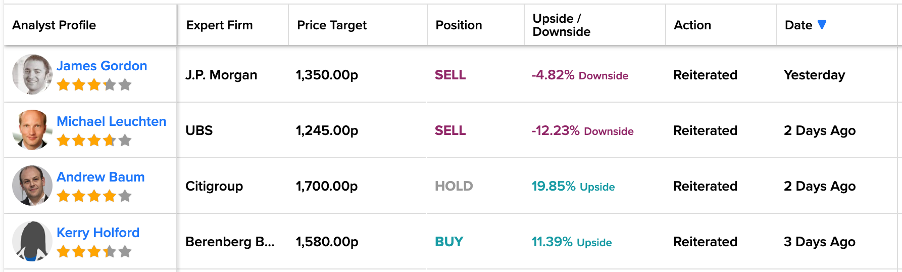

Analyst Michael Leuchten from UBS sees multiple risks on earnings and cost challenges in the long term. He believes Shingrix sales will start falling in the U.S. when it reaches its full potential in 2027. This could hit around 20% of the company’s revenues. Leuchten has the lowest target price of 1,245.0p on the stock, which indicates a downside of 12.23%.

Is GSK a Good Stock to Buy?

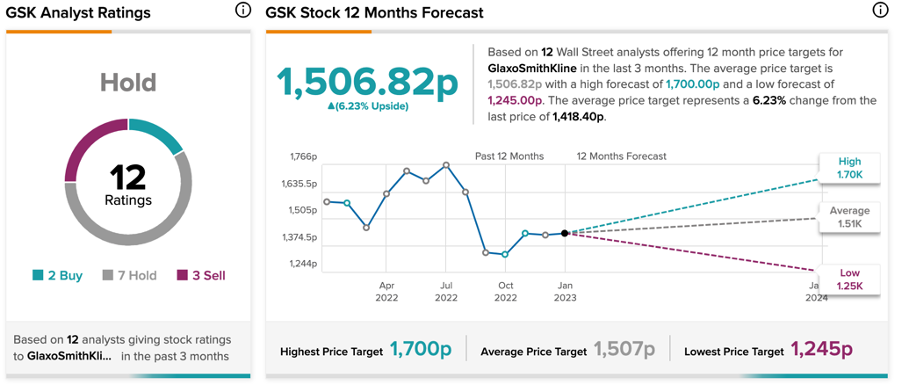

Recently, J.P. Morgan and UBS both reiterated their Sell ratings on the stock.

Overall, GSK’s average target price is 1,506.82p, which is 6.23% higher than the current trading levels. The stock has a Hold rating on TipRanks.

AstraZeneca Plc

Based in the UK, AstraZeneca is a multinational pharmaceutical company that serves millions of patients worldwide. The company created a lot of buzz with its successful launch of COVID-19 vaccines. The stock also gained momentum, with 32% returns in the last year.

AstraZeneca will report its Q4 and full-year results for 2022 on February 2, 2023. The company reported a record growth of 41% in its sales of $37.4 billion in 2021. Analysts are bullish on the results, considering the company’s strong pipeline of drugs. The company received around 19 regulatory approvals for its drugs in the first half of 2022.

The consensus forecast for EPS is 1.12p, lower than 1.67p in the Q4 of 2021. For the third quarter, the EPS was $1.67 per share, which represented a growth of 55% and even beat Wall Street’s estimates.

AstraZeneca increased its full-year guidance numbers based on favourable data from its pipeline programmes and stronger sales numbers. This month, the company received approval for Airsupra, which is the first of its kind for treating asthma in adults. AZN expects its annual revenue growth to be in the low double digits for the next 2-3 years.

AstraZeneca Share Price Target

Ahead of Q4 results, analysts from Deutsche Bank, Barclays, and J.P. Morgan have reconfirmed their Buy ratings, while UBS reiterated a Hold rating on the stock.

According to TipRanks’ rating consensus, AstraZeneca stock has a Moderate Buy rating.

The average target price is 12,095.5p, which is 8.13% higher than the current trading levels.

Conclusion

Pharmaceutical giants from the UK market have always been investors’ favourites due to their global presence and solid portfolio of drugs. Both GlaxoSmithKline and AstraZeneca companies are looking at positive numbers in their full results for 2022, but analysts remain more bullish on AZN.

Join our Webinar to learn how TipRanks promotes Wall Street transparency