The share price of the UK-based Associated British Foods PLC (GB:ABF) surged after the company reported solid 2023 numbers as shoppers continued their spending spree. The company, which owns the leading retail brand Primark, is confident in delivering “better than ever before” Christmas sales this year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Capitalizing on its robust performance, the company revealed a new share buyback program worth £500 million. Additionally, ABF proposed a final dividend of 33.1p per share and a special dividend of 12.7p per share. This led to a total dividend for 2023 of 60p per share, marking a 37% jump over last year.

The stock traded up by almost 7% on Tuesday, placing it among the top gainers on the FTSE 100 index. So far in 2023, the stock has gained around 40% in trading.

Associated British Foods, or ABF, is a diversified company with business spread across grocery, agriculture, ingredients, sugar, and retail. The company serves customers in more than 100 countries worldwide.

Resilient Growth in a Challenging Environment; Primark Shines

Revenues grew by 16% to £19.85 billion for the full year, driven by higher sales across segments along with a selective price increase. The company implemented the price hike to maintain its profitability and offset the volatile cost inflation. The pre-tax profits grew by 25% to £1.3 billion, compared to £1.07 billion reported in 2022.

Despite ongoing uncertainty in consumer demand, the company’s retail brand, Primark, finds itself in an exceptionally favorable position. The company maintains its belief that Primark’s offerings are highly appealing, not only to existing customers but also to new ones drawn in by its digital platform. Primark’s total turnover increased by 17% compared to the previous year, reaching £9 billion. Moreover, Primark registered a 33% increase in Christmas sales compared to the same period last year, with sales of Christmas jumpers and decorations rising by 40% and 46%, respectively.

Is ABF a Good Stock to Buy?

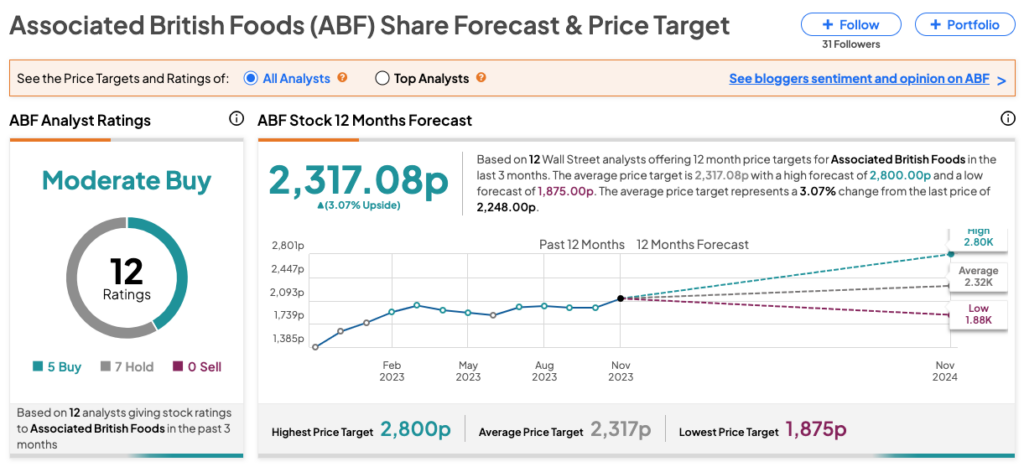

As per the consensus among analysts on TipRanks, ABF stock has been assigned a Moderate Buy rating. The company’s ratings consist of five Buy and seven Hold recommendations.

The ABF share price target is 2,317p, with a high and a low forecast of 2,800p and 1,875p, respectively. This price target indicates a modest change of 3% from the current share price.