The UK-based Diageo PLC (GB:DGE) settled its legal battle with American rapper Sean Combs, aka Diddy, ending the racism dispute regarding their DeLeón joint venture. According to a joint statement released yesterday, Diddy has retracted all his accusations against Diageo, and both parties no longer have any business relationship.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following this settlement, Diageo will retain sole ownership of the Cîroc vodka and DeLeón tequila brands. Diageo’s shares were trading down by 1.8% as of writing.

Diageo is a leading alcoholic beverage manufacturer, owning brands like Baileys, Smirnoff, Tanqueray, Guinness, etc.

Diageo and Diddy’s Racism Saga Ends

Diddy filed a lawsuit against Diageo in May 2023, accusing the company of racial discrimination and neglecting his vodka and tequila brands. He also blamed the company for typecasting its brands as “urban” and “black brands” and minimizing their appeal compared to George Clooney’s Casamigos tequila.

He further claimed that Diageo provided fewer production, distribution, and sales resources to his brands compared to other brands owned by the company.

Diageo, on the other hand, denied such allegations and stated that they had made efforts for years to repair the strained relationship with Combs.

The sudden resolution with Diageo also coincides with Combs facing several allegations of sexual assault.

What is the Forecast for Diageo Shares?

In 2023, the stock experienced volatility and traded down by 21%. The performance was mainly hit by margin pressures and macroeconomic challenges, which are expected to continue in 2024 as well.

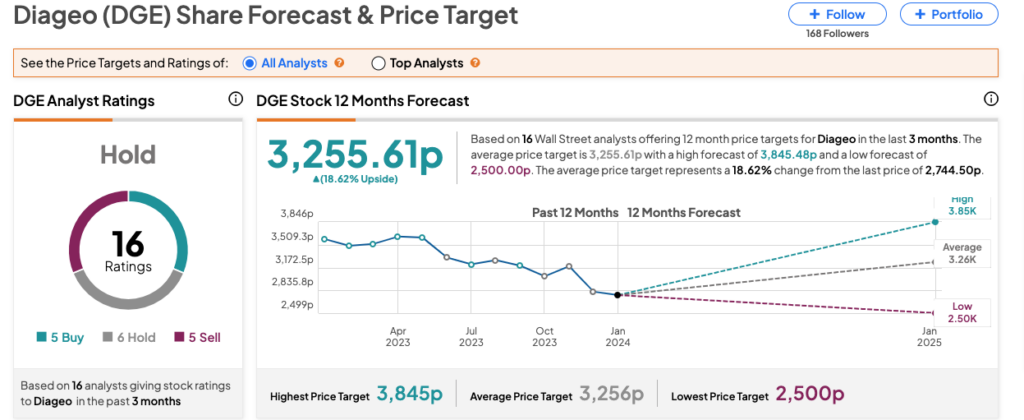

According to TipRanks’ consensus, DGE stock has received a Hold rating based on a total of 16 recommendations from analysts. This includes five Buy, six Hold, and five Sell recommendations. The Diageo share price target is 3,255.61p, which is 18.6% above the current trading levels.