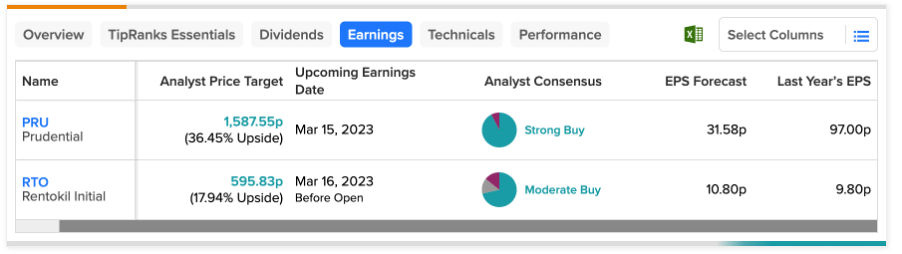

UK companies Prudential PLC (GB:PRU) and Rentokil Initial PLC (GB:RTO) will announce their 2022 earnings this week. Ahead of their results, analysts are bullish on these companies and have reiterated their Buy ratings on the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The TipRanks tools like Earnings Calendar and Stocks Comparison fit here perfectly. With the Earnings Calendar, investors can screen the stocks for upcoming results and then compare them on different parameters using the comparison database. These tools are available in the seven different markets on TipRanks.

Let’s have a look at the details.

Prudential PLC

Prudential is a UK-based financial company that provides life and health insurance and other asset management services to customers. The company operates in around 23 markets across Asia and Africa.

Lately, the company’s stock has been trading lower and has lost almost 9% in the last five days. The stock is currently trading lower than the 52-week high point touched in January 2023.

The company will announce its fourth quarter and full-year results for 2022 on March 15. According to TipRanks, the forecasted EPS for Q4 is 0.32p, much lower than 0.97p in the same quarter a year ago.

Analysts remain bullish on the company’s performance and the long-term growth potential of the stock. Analysts feel the stable business model and diverse geographical presence provide resilience during challenging situations. Another bullish aspect of the earnings is the post-reopening recovery in the markets of Asia and Africa, which is driving the topline growth.

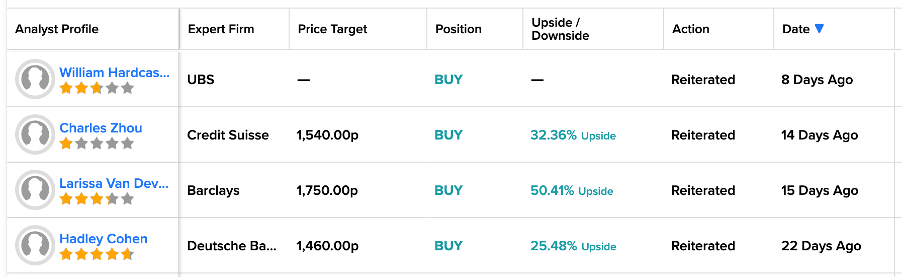

Over the last months, analysts from UBS, Credit Suisse, Barclays, and Deutsche Bank have reiterated their Buy rating on the stock.

Prudential Share Price Forecast

The Prudential stock has a Strong Buy rating on TipRanks, based on a total of 13 recommendations. It includes 12 Buy and one Sell ratings.

The PRU stock has an average target price of 1,587.5p, which is 36% higher than the current level.

Rentokil Initial PLC

Rentokil is among the leading pest control service companies in the world. Even though the company is based in the UK, over 90% of its revenue is generated from other countries.

The company is all set to announce its preliminary results for 2022 on Thursday, March 16. On TipRanks, the consensus EPS forecast for the fourth quarter is 0.11p per share. The revenue forecast for the same quarter is £2.1 billion.

Overall, analysts are highly bullish on the company’s upcoming earnings based on its strong acquisitions in 2022. In the first three quarters, the company acquired 43 businesses in the pest control and hygiene space with total revenues of £95.1 million.

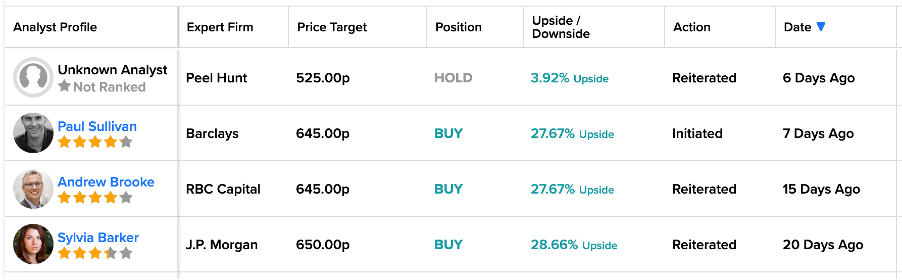

Recently, analyst Sylvia Barker from J.P. Morgan reiterated their Buy rating on the stock at a target price of 650p with a 28.6% upside. Barker is optimistic about the recent acquisition of a U.S.-based competitor, Terminix International Company, which will enhance long-term equity growth. She also commented, “The risk/reward is significantly attractive” for the stock.

Are Rentokil Shares a Good Buy?

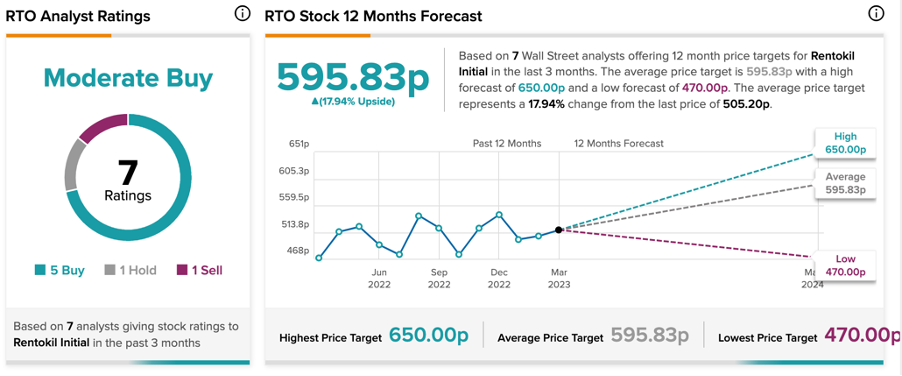

RTO stock has a Moderate Buy rating on TipRanks, based on five Buy, one Hold, and one Sell recommendations. The average target price is 595.83p, which shows an upside of 18%.

Conclusion

Analysts are bullish on the 2022 numbers for both Prudential and Rentokil and have rated them as Strong Buy and Moderate Buy, respectively.

Prudential is expected to post higher revenues based on the recovery in Asian and African markets. However, higher inflation costs still remain a concern. The recent decline in the stock price presents an attractive entry point for investors.

For Rentokil, analysts feel the acquisitions will boost the company’s revenues in Q4 and 2023.