The share price of the UK-based 888 Holdings (GB:888) jumped after it reportedly rejected the takeover bid by the software development company Playtech PLC (GB:PTEC) for £700 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

888 Holdings Turns Down Playtech’s Offer

As reported by The Sunday Times, Playtech made a proposal to acquire 888 Holdings for 156p per share in July. Nonetheless, 888 Holdings declined the offer, asserting that it underestimated the company’s true value. The rejection ignites speculation about forthcoming negotiations and the possibility of alternative offers. Investors and analysts will keenly observe the situation to assess 888’s future.

The stock traded up by 20.6% on Monday, reaching 84p. Over the last 12 months, 888 Holdings shares have lost around 18% of their value, mainly hit by competitive pressures, a slowdown in demand, and regulatory challenges.

Based in the UK, 888 Holdings is a betting and gaming company with a worldwide footprint. The company boasts a diverse portfolio of gaming software, including well-known brands such as William Hill, 888casino, 888poker, 888Bingo, and 888sport.

888’s Independent Endeavor

Last month, the Financial Times reported that DraftKings Inc. (NASDAQ:DKNG), a U.S.-based gambling company, engaged in early-stage talks over a potential bid for 888 in June and July, involving its key shareholders.

Despite persistent takeover speculations surrounding 888 and evident interest from certain competitors, the company’s management intends to remain independent, at least for now.

Analysts widely perceive 888 as a takeover target due to its diminished share price, triggered by management changes, compliance issues, and a recent profit warning. The company reduced its annual profit expectations following a 10% decline in third-quarter revenue.

888 Holdings Share Price Target

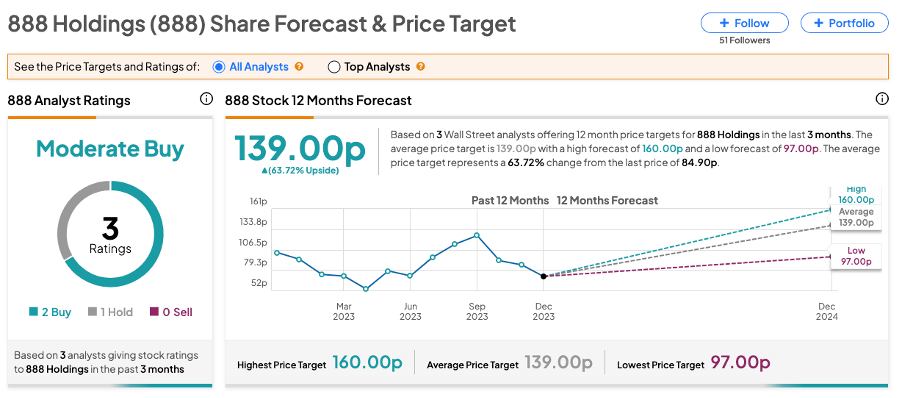

Yesterday, analyst James Wheatcroft from Jefferies reiterated a Buy rating on the stock, predicting a huge upside of over 90%.

According to TipRanks, 888 stock has received a Moderate Buy consensus rating with two Buys and one Hold recommendation. The 888 share price target is 139p, which is 64% higher than the current price level. The highest target price forecast for 888 Holdings shares is 160p and the lowest price target is 97p.