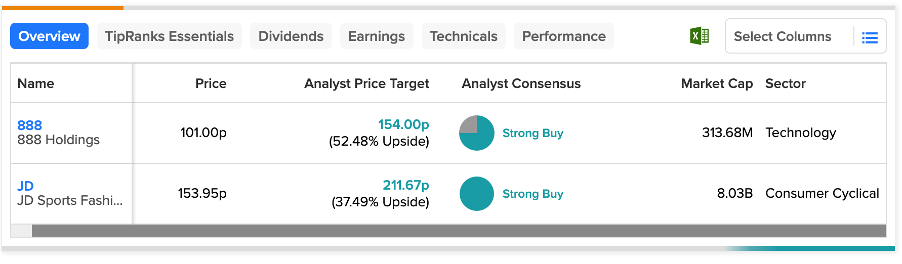

UK-based 888 Holdings (GB:888) and JD Sports Fashion (GB:JD) have earned Strong Buy ratings from analysts. 888 exhibits substantial potential for a share price increase of over 50%, whereas JD Sports presents an upside of 37.5%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TipRanks’ ‘Strong Buy’ rating serves as a guide for identifying stocks that offer long-term returns. TipRanks offers a range of tools, such as its Shares Screener, Stock Comparison, High-Dividend Stocks, and more, to aid in the selection of stocks from any given market.

Let’s take a look at the details.

888 Holdings PLC

888 Holdings is a prominent betting and gaming company with a global presence. It possesses a portfolio of gaming software, including 888casino, 888poker, 888Bingo, and 888sport.

Yesterday, the company’s stock soared by more than 25% after FS Gaming Investments announced the acquisition of a 6.5% stake in 888. Overall, the stock has gained around 45% in the last three months. The investment consortium includes some big names from the gambling industry, and analysts see this as a favorable opportunity.

Analysts believe this investment could expedite the execution of the current strategy and help identify fresh avenues for growth for the company. Moreover, it could also lead to leadership changes and mark a more bullish period for the stock.

Yesterday, Simon Davies from Deutsche Bank reiterated his Buy rating on the stock. His price target of 145p represents an upside of 45% in the share price.

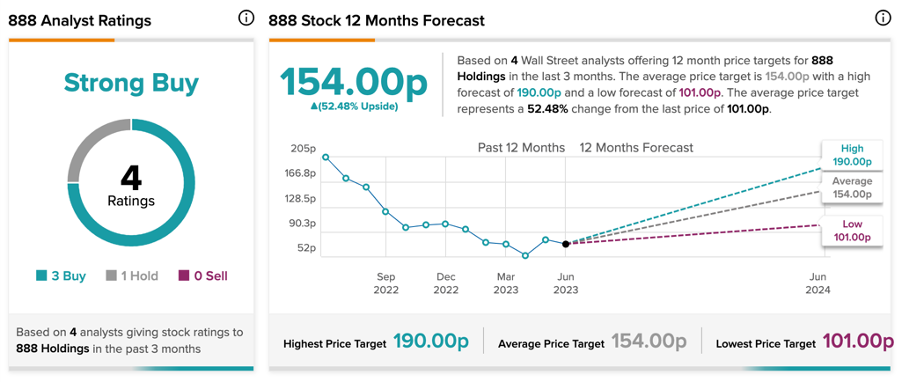

888 Holdings Share Price Target

According to TipRanks’ analyst consensus, 888 stock has a Strong Buy rating with three Buy and one Hold recommendations.

The average price target is 154p, which is 52.5% higher than the current price level. The price has a high forecast of 190p and a low forecast of 101p.

JD Sports Fashion PLC

JD Sports is a British retail company specializing in sports and fashion brands. The company brings together renowned global brands like Nike, Adidas, Puma, etc. alongside its own brand labels such as Pink Soda and Supply & Demand.

In May, the company reported its 2023 earnings with record sales numbers. The company’s revenue increased from £8.56 billion last year to £10.12 billion in 2023. The pre-tax profit for the year amounted to £991.4 million, exceeding both the projected figures and the results from the previous year. For the fiscal year 2023-24, the company projects a profit before tax of £1.03 billion.

Post-results, analysts have reaffirmed their Buy ratings on the stock, indicating their confidence in the reported figures. 17 days ago, Simon Irwin from Credit Suisse reiterated his Buy rating on the stock, predicting a growth of 43% in the share price. On the same day, Richard Chamberlain of RBC Capital also maintained his Buy rating with a 30% upside potential.

JD Sports Share Price Forecast

JD stock has a Strong Buy rating on TipRanks backed by all four Buy recommendations.

The average target price is 211.67p, which represents a growth of 38% on the current price level.

Conclusion

Analysts have assigned positive ratings to both 888 and JD based on the recent deal and solid financial numbers, respectively. The solid investment case is supported by the analysts’ ‘Strong Buy’ ratings, further strengthening the outlook.