Incorporating a few ETFs (exchange-traded funds) in one’s investment portfolio can enhance diversification and risk management. These funds track indexes such as stocks, bonds, and commodities like Gold, among others, and offer the advantage of increased returns.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Today, we will discuss three such ETFs listed on the ASX that offer balanced growth to investors.

Let’s dig deeper.

ETFS Physical Gold (AU:GOLD)

Global X Physical Gold is intended to provide investors with an uncomplicated, cost-effective, and secure means of obtaining physical gold exposure.

The fund started in March 2003 with the objective of closely tracking the price and yield performance, excluding fees and expenses, of the Gold Price PM in Australian dollars. It has over AU$2.7 billion in total assets under management. The ETF has delivered a total return of 7.36% p.a. for a 10-year period. In addition, the fund achieves this growth at a modest expense ratio of 0.25%.

In terms of its trading price, the ETF has been trading up by 11.28% YTD. The fund’s trading price has generated a return of 68.2% over the past five years.

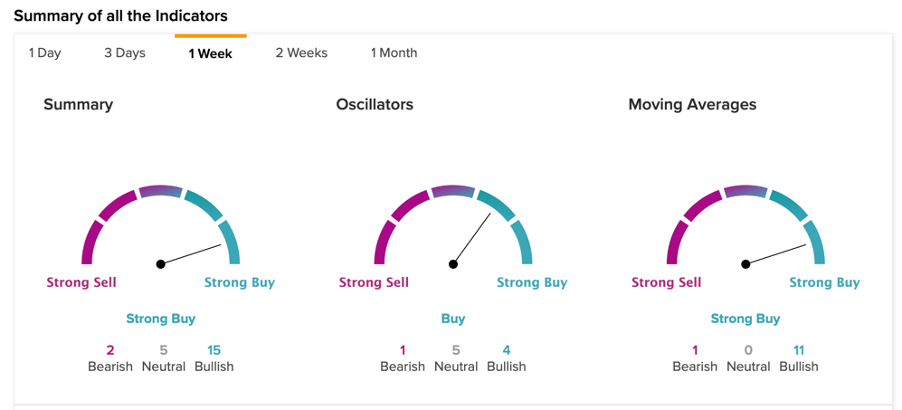

Moving onto the technical analysis, the fund has a Buy rating on the summary signal within the time frame of one week. The summary signal includes a Strong Buy signal from the moving averages and a Sell signal from the oscillators. With a 10-day exponential moving average of AU$27.31 and a current share price of AU$27.84, ETFS Physical Gold is considered a Buy.

VanEck Morningstar Wide Moat ETF (AU:MOAT)

The objective of the VanEck Morningstar Wide Moat ETF is to closely mirror, before fees and expenses, the price and yield performance of the Morningstar Wide Moat Focus Index. The fund was started in 2012 and has delivered lifetime returns of 14% against the S&P’s return of 12.79% during the same period.

MOAT, which focuses on companies with enduring competitive advantages, has been consistently outperforming the S&P 500 index (SPX). The fund has also demonstrated positive trading performance, generating a return of 47.5% in the last three years.

The index consists of the IT sector, which represents 29.2% of the net assets, with the three highest holdings being Meta Platforms Inc. (NASDAQ:META), Salesforce.com Inc. (NYSE:CRM), and Microsoft Corp. (NASDAQ: MSFT).

According to TipRanks’ technical analysis, the fund has a Buy rating within a time frame of one week. The summary signal includes a Strong Buy from the moving averages and a Buy from oscillators.

Vanguard Australian Shares Index ETF (AU:VAS)

The objective of the Vanguard Australian Shares Index ETF is to replicate the performance of the S&P/ASX 300 Index. This ETF delivers cost-effective and diversified exposure to Australian firms and property trusts that are listed on the ASX, resulting in long-term capital appreciation as well as dividend income.

Since being introduced in 2009, the fund has delivered a cumulative return of over 100% within the past decade. Its overall market capitalization is AU$48.7 billion, and nearly 98% of its investments are in the Australian market.

The top five holdings of the fund are BHP Group Ltd. (AU:BHP), Commonwealth Bank of Australia (AU:CBA), CSL Ltd. (AU:CSL), National Australia Bank Limited (AU:NAB), and Westpac Banking (AU:WBC).

TipRanks’ technical analysis indicates that the fund has a Buy rating for a one-week timeframe, with Strong Buy signals from the moving averages and a Buy signal from oscillators.

Bottom Line

The three ETFs discussed above offer low-cost and diversified investment options for investors. Moreover, the technical analysis suggests a Buy signal for all three of them for a one-week period.