The Deutscher Aktien Index, or DAX 40, comprises 40 of the biggest companies traded on the Frankfurt exchange. The index traded down by 5.75% in the last year but has already started gaining momentum and gained 17.08% in the last six months. Moving forward, the analyst expects that the opening of the Chinese economy will provide further support to German stocks due to their higher exposure to China.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

We have picked up logistics company Deutsche Post (DE:DPW) and chemicals manufacturer BASF SE (DE:BAS) from the DAX 40. These are large-cap companies with consistent dividend payments. Moreover, the Buy ratings from analysts make them a good choice for investors in 2023.

The TipRanks Dividend Calendar tool helps investors find the dividend payment schedule of companies in a particular market. This tool could be used by investors to find out the next dividend date in the German market.

Let’s see what’s working for these two companies.

Deutsche Post DHL Group

As one of the largest logistics companies in the world, Deutsche Post enjoys a competitive advantage along with solid profitability.

In its third-quarter results for 2022, revenue grew by 20%, mainly driven by its international business. Among its divisions, global forwarding and freight saw a maximum jump of 38% in its revenues. The total net profit increased by 13% to €1.1 billion. The solid operational performance also strengthened the company’s financial capacity. The free cash flow increased from €1.3 billion in the third quarter of 2021 to €1.8 billion in this quarter.

The company even raised its earnings guidance to €8.4 billion for 2022 and confirmed the mid-term outlook for 2024.

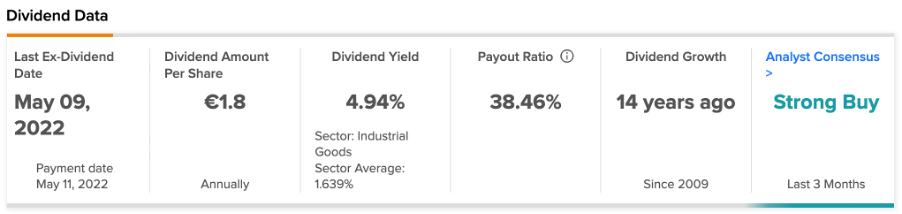

Based on the numbers, the dividends look safe and are covered by earnings. In 2021, the company announced a dividend of €1.8 per share at a payout ratio of 43.6%. The dividend yield is at 4.94%, higher than the industry average of 1.6%.

The company’s stock has been trading down by 28% in the last year, which presents a good buying opportunity for investors.

Deutsche Post Stock Forecast

Deutsche Post’s stock enjoys a Strong Buy rating on TipRanks, based on nine Buy and three Hold recommendations.

The average target price is €48.41, which represents a 27.3% change from the current price level.

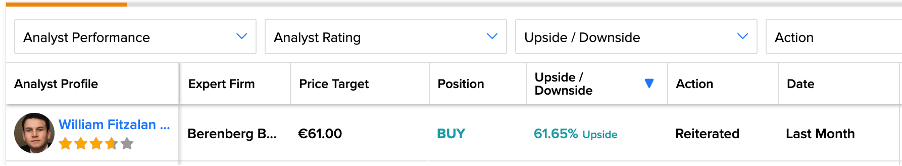

Berenberg Bank’s analyst William Fitzalan Howard has the highest target price of €61.0 on the stock.

BASF SE

BASF is a leading chemical producer, serving industries such as electronics, packaging, pharmaceuticals, textiles, agriculture, and more. The company has a market capitalization of €50.23 billion on the Frankfurt stock exchange.

The company’s top-class expertise in products, a diversified group of customers, a global presence, and solid dividends make it an attractive investment. The company is also a part of the DivDAX share index, which includes Germany’s top dividend-paying companies.

BASF has a dividend yield of 6.59%, and it paid a dividend of €3.4 per share in May 2022. The company follows a progressive policy and aims to increase its per-share dividend every year.

The dividends were backed by a good performance, despite a challenging environment. The company’s third-quarter sales for 2022, were €21.9 billion, up from €19.7 billion in the prior year’s quarter. The earnings were slightly down at €1.3 billion, due to higher energy and raw material costs. To overcome this hurdle, the company has started a cost-saving program in Germany and Europe, that targets achieving an annual goal of €500 million in 2023 and 2024.

Is BASF a Good Stock to Buy?

According to TipRanks’ analyst consensus, BASF stock has a Moderate Buy rating, based on a total of 12 recommendations.

The target price is €54.04, which shows a slight change of 1.75% from the current price levels. The stock has gained around 22.6% in the last six months.

Conclusion

Despite operating in a challenging environment, these companies have managed dividend growth for their shareholders. Their dominant position in their respective industries helps them navigate the difficulties smoothly. They seem to be the perfect addition for income investors.