Global-e Online (NASDAQ:GLBE) shares plunged nearly 15% in the early session today after the cross-border eCommerce platform announced its results for the fourth quarter. Revenue soared by 32.6% year-over-year to $185.4 million, outpacing expectations by $3.7 million. However, net loss per share of $0.13 came in wider than estimates by $0.01.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In Q4, GLBE’s GMV (Gross Merchandise Value) increased by 42% year-over-year to $1.19 billion. Further, its adjusted EBITDA jumped by 62% to $35.2 million.

For Fiscal Year 2024, the company expects a GMV of $4.59 billion to $4.83 billion. Adjusted EBITDA for the year is expected to be $121 million to $137 million on a revenue range of $731 million to $771 million. For the upcoming quarter, GLBE anticipates revenue of between $138.5 million and $145 million. Adjusted EBITDA is seen landing in the range of $16 million to $20 million. Importantly, despite uncertain macroeconomic conditions, Global-e remains optimistic about its long-term growth prospects and profitability.

Is Global-e a Good Stock to Buy?

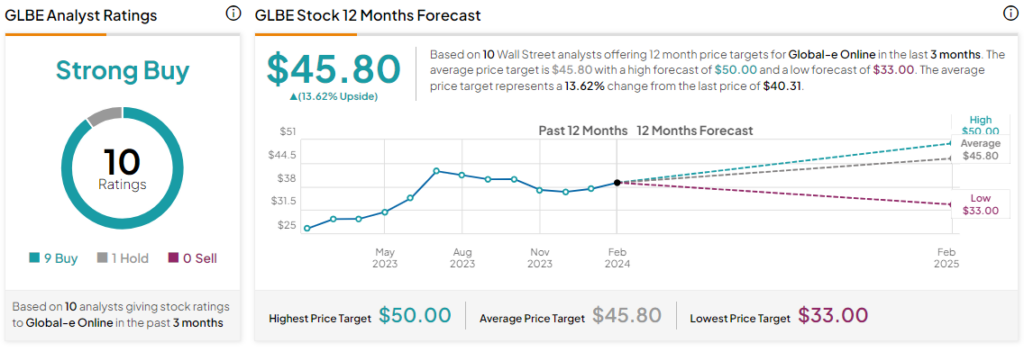

Today’s price decline comes after a nearly 54% rise in Global-e’s stock price over the past year. Overall, the Street has a Strong Buy consensus rating on Global-e alongside an average price target of $45.80. However, analysts’ views on the stock could see revisions following its Q4 performance.

Read full Disclosure