Mining company Glencore (GB: GLEN) attempted to sweeten the deal for the takeover of Canadian miner Teck Resources (NYSE: TECK) on Wednesday. In an open letter to Teck’s Class B shareholders, Glencore stated that it is attempting to improve its $22.5 billion initial takeover offer and will include a “cash component, to buy shareholders out of their coal exposure such that Teck shareholders would receive up to $8.2 billion in cash or 24% of CoalCo.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Glencore added that it was willing “to consider making improvements to its proposal.” This proposal comes even as Teck had earlier rejected the company’s unsolicited takeover offer. Teck is planning to split up its base metals and steelmaking coal businesses and this plan will be up for voting on April 26.

Glencore added in its letter to Teck’s shareholders that this separation plan could “introduce significant complexity and impede future transactions.” The company’s takeover offer comes even as there have been reports that multiple buyers are interested in Teck’s base metals business.

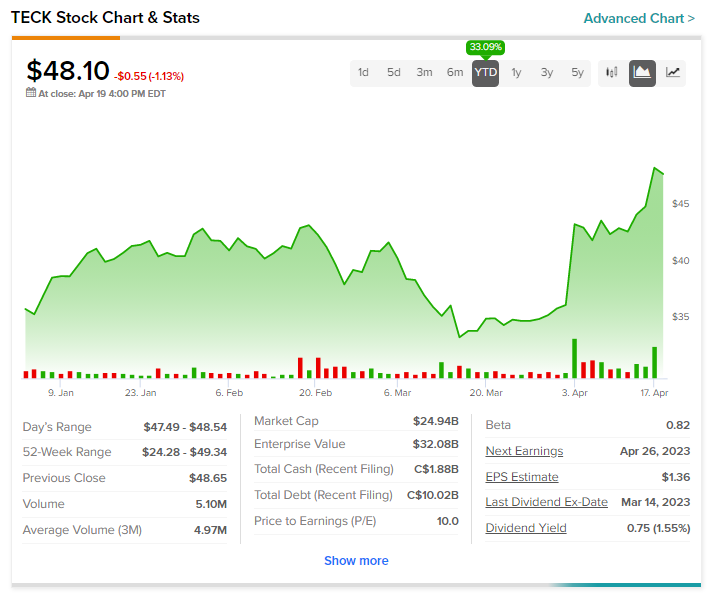

Teck stock has soared by more than 30% year-to-date.