Shares of software company GitLab (NASDAQ:GTLB) gained in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2024. Earnings per share came in at $0.09, which beat analysts’ consensus estimate of -$0.01 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased by 32% year-over-year, with revenue hitting $149.7 million. This beat analysts’ expectations by $8.17 million.

According to Brian Robins, GitLab’s CFO, the revenue boost demonstrates the company’s continued business momentum driven by its market approach. “We continue to grow responsibly and delivered over 2,200 basis points of non-GAAP operating margin expansion. I am pleased to share that we had our first quarter of non-GAAP operating profit while continuing to invest in key product areas, including security, compliance, AI, and Enterprise Agile Planning.”

Looking forward, management now expects revenue and adjusted earnings per share for Q4 2024 to be in the ranges of $157 million to $158 million and $0.08 to $0.09, respectively. Analysts forecast earnings of $0.01 and revenue of $149.4 million.

For the Fiscal Year 2024, GitLab expects EPS to land between $0.12 and $0.13 versus the consensus estimate of -$0.06. Furthermore, the company sees revenue coming in at $573 million to $574 million, versus consensus expectations of $557 million.

Is GTLB a Good Stock to Buy?

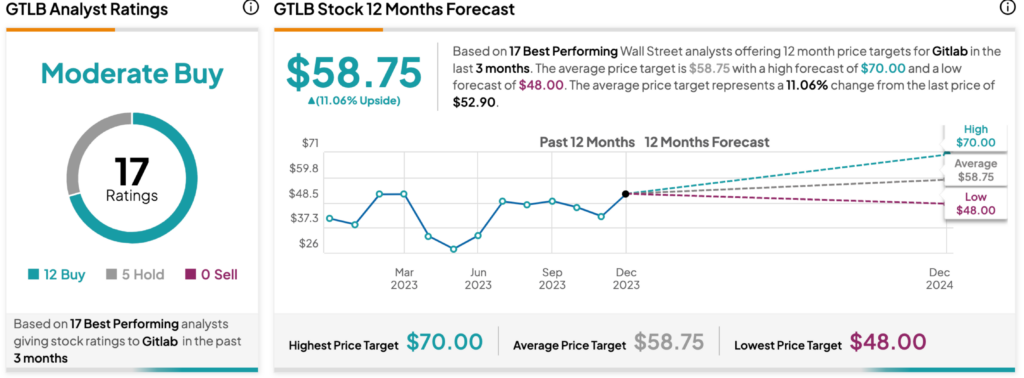

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GTLB stock based on 12 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 20.42% increase in its share price this year, the average GTLB price target of $58.75 per share implies 11.06% upside potential.