GitLab (NASDAQ:GTLB) shares are on the rise today after the DevSecOps (Development, Security, and Operations) platform delivered blowout second-quarter numbers. Revenue rose 38.2% year-over-year to $139.6 million, outpacing estimates by $9.8 million. EPS of $0.01 came in better than expectations by a wide margin of $0.04.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This robust performance was driven by GitLab’s focus on product innovation and strong customer demand. The company was recently named as a category leader by Gartner and Forrester. During the quarter, GitLab’s dollar-based net retention rate stood at 124%, with the number of customers with annual recurring revenue of over $100,000 rising by 37% to 810.

Looking ahead to the full fiscal year 2024, GitLab expects revenue to hover between $555 million and $557 million. The net loss per share for the year is anticipated to be between $0.08 and $0.05. Furthermore, the company expects third-quarter revenue to be in the range of $140 million and $141 million, alongside a net loss per share in the range of $0.02 and $0.01.

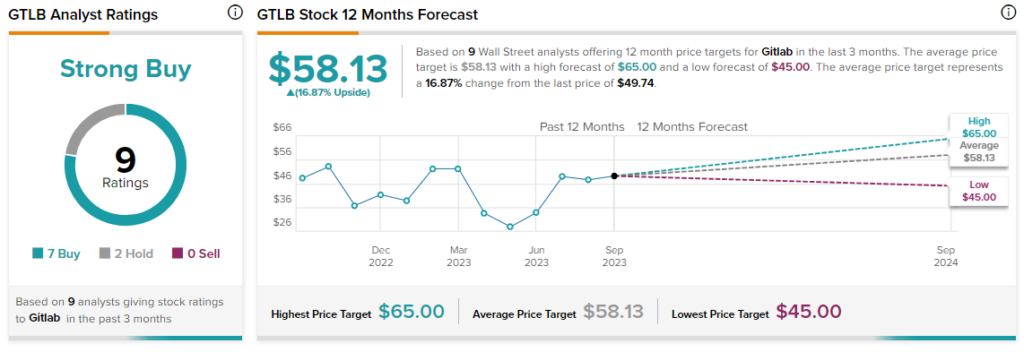

Overall, the Street has a consensus price target of $58.13 on GitLab, along with a Strong Buy consensus rating. Today’s price gains further add to the 7.3% rise in GitLab shares over the past month alone.

Read full Disclosure