As the world’s most valuable publicly traded company, Apple (NASDAQ:AAPL) consistently faces high expectations. As it prepares to release its Q3 earnings report on August 1st, the question remains: can it deliver the performance investors are anticipating?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mike Zaccardi, a 5-star investor ranked in the top 1% of TipRanks’ stock pros, believes that it can and expects Apple stock to be well-positioned for further gains.

“Apple’s strong financial position, improving EPS outlook, and shareholder-friendly moves make it an attractive investment,” Zaccardi opined.

Zaccardi is particularly bullish about Apple’s ability to build value through both its AI applications and a computer refresh cycle.

Though the investor expects to see a year-over-year drop in iPhone sales in the upcoming print, Zaccardi believes that increased hardware sales are on the horizon “now that we are four years removed from the at-home electronics buying binge during COVID.”

In addition, Zaccardi believes that recent company decisions to support shareholder-friendly moves are another feather in Apple’s cap. These decisions include a $110 billion repurchase authorization and a 4% dividend hike announced in May, following Apple’s return of $100 billion to shareholders in 2023.

While Zaccardi concedes that Apple stock is not cheap, the top investor views “the megacap as a renewed growth story while the company continues to reward shareholders through dividends and buybacks.” The investor highlights Apple’s commanding industry presence, high and sustainable margins, and unique consumer-staple-like penetration in everyday life as key strengths.

Unsurprisingly, Zaccardi rates Apple shares a Buy, setting a 12-month price target of $245, which represents a potential upside of ~10% from current levels.(To watch Zaccardi’s track record, click here)

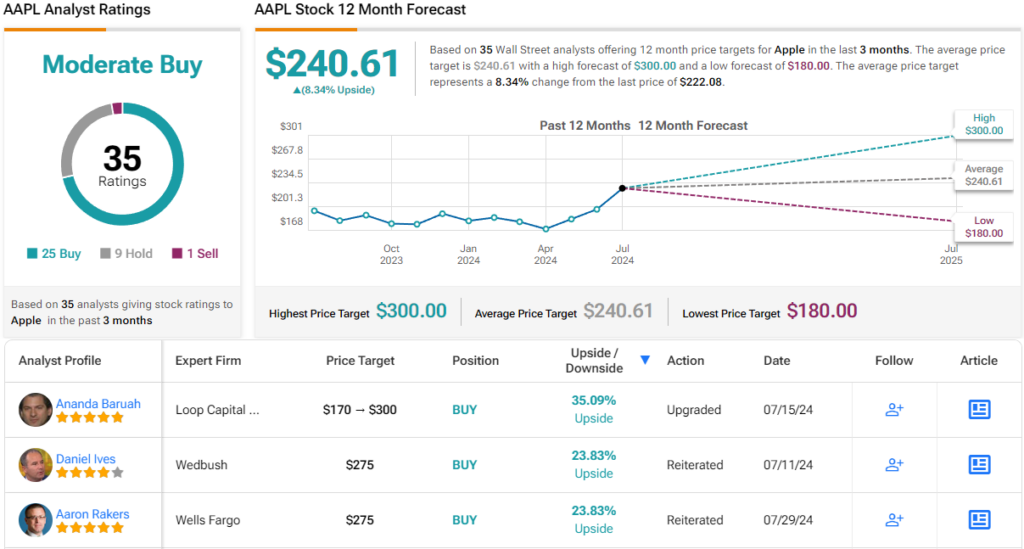

Wall Street analysts generally agree with Zaccardi’s take. With 25 Buy ratings, 9 Holds, and 1 Sell, Apple stock boasts a Moderate Buy consensus rating. The average price target of $240.61 suggests a potential growth of about 8% from current levels. (See AAPL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.