Danish biotechnology company Genmab A/S (NASDAQ: GMAB) revealed that epcoritamab (DuoBody-CD3xCD20) has been granted Orphan Drug Designation (ODD) by the U.S. Food and Drug Administration (FDA). Epcoritamab is being co-developed by Genmab and AbbVie (NYSE: ABBV).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Epcoritamab is an investigational IgG1-bispecific antibody designed to treat follicular lymphoma (FL). The medicine helps in directing cytotoxic T cells selectively to tumors to induce an immune response towards malignant cells.

Epcoritamab is currently undergoing several clinical trials, including phase 1/2 EPCORE NHL-1. According to Genmab’s website, The trials are conducted to evaluate the “efficacy and safety of subcutaneous epcoritamab in patients with relapsed or refractory B-cell non-Hodgkin’s lymphoma (B-NHL), including diffuse large B-cell Lymphoma (DLCBL), follicular lymphoma (FL), and mantle cell lymphoma (MCL).”

ODD status is granted by the FDA to medicines that are used to treat and prevent rare diseases affecting less than 200,000 people in the U.S. Specifically, about 2.7 per 100,000 individuals in the U.S. are newly diagnosed with FL annually.

Official Comments

Noting the milestone, Genmab CEO Jan van de Winkel said, “With AbbVie, we remain committed to further developing epcoritamab in this patient population, as well as in patients diagnosed with other B-cell hematologic malignancies.”

Wall Street’s Take

Recently, Citigroup (C) analyst Andrew Baum maintained a Buy rating on AbbVie and lifted the price target to $170 (15.53% upside potential) from a previous $155 per share.

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 11 Buys and five Holds. The average AbbVie price target of $149.93 implies 1.89% upside potential from current levels. Shares have gained 44.2% over the past year.

Risk Analysis

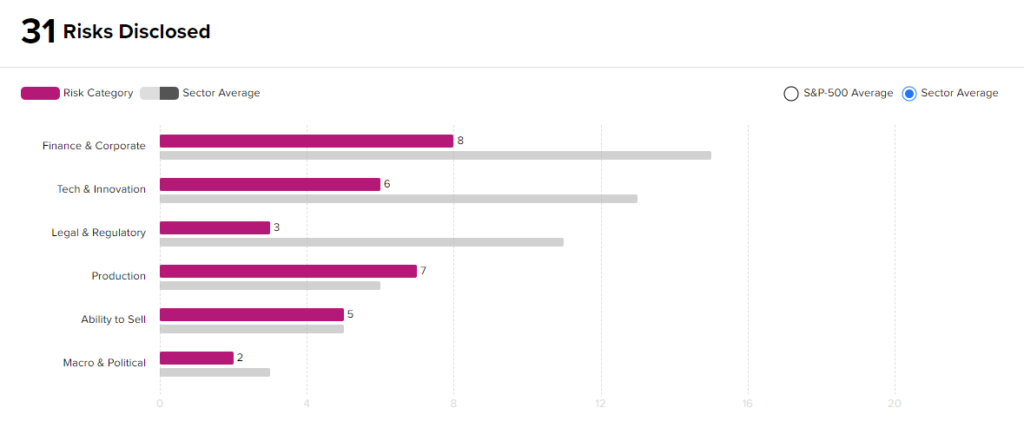

According to the new TipRanks Risk Factors tool, the AbbVie stock is at risk mainly from two factors: Finance & Corporate and Production, which contribute 8 and 7 risks, respectively. In total, 31 risks were identified for the stock.

Though AbbVie is at a higher risk from a production standpoint than other companies in its industry, it remains less risky from a financial standpoint. Given its risk profile and positive clinical development, investors might want to consider adding AbbVie to their portfolios.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

bluebird bio Reports Quarterly Loss, Provides Clinical Updates

Bed Bath & Beyond Jumps over 34% on Cohen’s Stake Disclosure

Citigroup on Hiring Spree, Plans to Expand Global Workforce