General Motors (NYSE:GM) is allocating approximately $632 million towards the enhancement of its Fort Wayne assembly plant in Indiana. This investment aims to facilitate the manufacturing of next-generation light-duty pickup trucks. The invested funds will be utilized for the implementation of new conveyors, tooling, and equipment in the body and general assembly sections of the plant.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Notably, GM has made several similar announcements in the past week as part of its preparations to meet rising production demands. The positive developments have contributed to an impressive 11% surge in GM stock over the past week, with analysts projecting additional upside potential.

GM’s Other Initiatives to Drive Growth

Last week, the company disclosed plans to spend over $500 million towards the upgrade of its Arlington, Texas, plant, enabling the production of internal combustion engine (ICE) full-size SUVs at the facility. Additionally, GM is investing $1 billion in two locations in Flint, Michigan, to prepare them for the production of next-generation ICE heavy-duty trucks.

Additionally, General Motors is scaling up production of batteries. In this regard, the company has set a target for its Ultium plant in Ohio to achieve full capacity by the end of 2023. Furthermore, GM has invested approximately $650 million in a Lithium plant operated by Lithium America. This strategic investment aims to enhance the supply of Lithium, a crucial component of electric vehicle batteries, further supporting GM’s efforts to strengthen its battery supply chain.

Also, General Motors has entered into a deal with EV giant Tesla (TSLA) under which GM EV drivers can use Tesla’s supercharger network.

These investments will help GM achieve its goal of exclusively offering electric vehicles (EVs) by 2035. Notably, the company has made remarkable strides in the EV sector, as evident from its delivery of over 20,000 EVs in the United States during the first quarter. Furthermore, GM has observed an impressive 800 basis point increase in its EV market share, indicating substantial progress and success in this market segment.

Is GM a Good Stock to Buy?

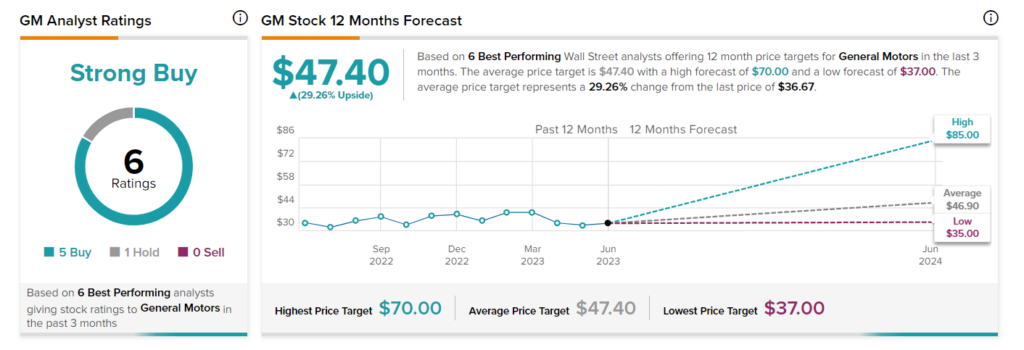

Out of the six top analysts who recently rated GM stock, five assigned a Buy rating and one suggested a Hold. Overall, top analysts are optimistic about General Motors with a Strong Buy consensus rating. Moreover, the consensus 12-month price target of all top analysts of $47.40 implies an upside potential of 29.3% at present.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations. Moreover, each analyst has a remarkable success rate.