General Motors (NYSE:GM) is facing labor challenges in Canada, which are expected to add fuel to the fire already caused by the ongoing UAW union strike and the recent 20 million airbag recall. The stock dropped over 6% last week and is currently trading near its three-year low at $29.72, owing to investors’ concerns over these issues.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Canada Labor Woes

The company’s Canadian plants located in Ontario are at risk of shutting down as GM has yet to reach an agreement with Unifor, a Canadian general trade union, before the strike deadline date of October 9. The union is demanding General Motors match a new three-year deal it recently signed with Ford Motor (F).

The deal involves a 19% wage hike for senior workers and a 28.5% increase in pay for junior union members. Other discussions include the transition of part-time workers to full-time, pension plans, one-time bonuses, and commitments for future investments in the plants.

It is important to note that General Motors compensated for production interruptions caused by the UAW strike at its U.S. facilities by maintaining uninterrupted production of its pickup trucks at its Canadian factories. Therefore, a strike in Canada at this moment would come as a major blow to the company’s production and distribution numbers.

Is GM a Good Stock to Buy?

General Motors recently reported impressive U.S. auto sales figures for the third quarter. However, the outlook for the current quarter may be less optimistic if the company is unable to reach a timely agreement with the unions. Nevertheless, GM remains one of the top automakers, and its electrification push is expected to play a significant role in future growth prospects.

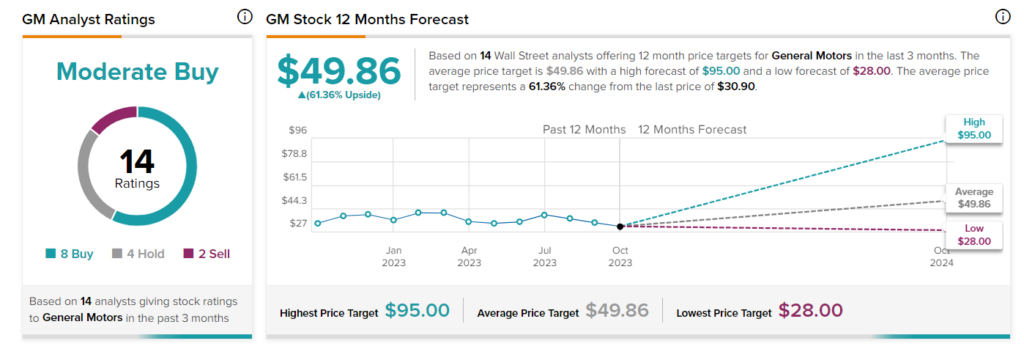

Wall Street analysts currently project a 61.4% jump in GM stock to reach the average price target of $49.86 in 12 months’ time. General Motors stock has a Moderate Buy consensus rating based on eight Buys, four Holds, and two Sells. Year-to-date, shares of the company are down 7.9%.