General Motors (NYSE:GM) shares jumped nearly 8% in the early session today after the automotive major delivered an impressive set of fourth-quarter numbers. Revenue of $42.98 billion outpaced expectations by $4.17 billion. Further, EPS of $1.24 comfortably exceeded estimates by $0.08.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In Automotives, GMNA (GM North America) segment net sales remained largely unchanged at $35.23 billion. However, net sales in the GMI (GM International) segment declined to $3.94 billion from $4.32 billion in the year-ago period. On the other hand, GM’s net income margin improved by 30 basis points to 4.9% in Q4. The company’s total North American market share dropped to 15.2% from 16.2% in the prior year period. In sync, its market share in China dropped to 7.9% from 9.1% in the year-ago period.

For Fiscal Year 2024, the company anticipates adjusted EPS in the range of $8.50 to $9.50. Capital spending for the year is expected to hover between $10.5 billion and $11.5 billion. Yesterday, GM increased its quarterly dividend by 33% to $0.12 per share. The GM dividend is payable on March 14 to investors of record on March 1.

Is GM a Good Stock to Buy?

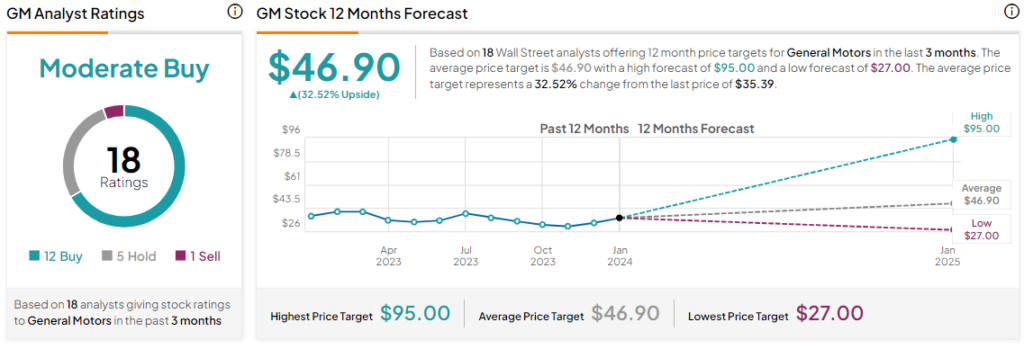

Overall, the Street has a Moderate Buy consensus rating on General Motors and the average GM price target of $46.90 implies a substantial 32.5% potential upside in the stock. That’s after a nearly 7.8% drop in the company’s share price over the past six months.

Read full Disclosure