Global automaker General Motors (NYSE:GM) and South Korea’s POSCO (NYSE:PKX) will receive funding of C$300 million ($224 million) from the Canadian government to build their battery materials facility in Quebec. Both Canada’s federal government and Quebec’s authorities will share the budget equally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The GM-POSCO plant was unveiled last year, aiming to build a cathode active material (CAM) manufacturing plant for use in electric vehicles (EVs). The project’s total cost is pegged at roughly C$600 million and is expected to be operational by 2025. The factory will be hosted in Becancour, Quebec, and will create up to 200 jobs in Canada. Canada is known for its abundance of rare minerals and mining activities, and the government seeks to make Quebec the hub of the EV battery supply chain.

Commenting on the deal, Canadian Industry Minister Francois-Philippe Champagne said, “This investment in GM-POSCO’s new facility in Becancour will help further position Quebec as a key hub in Canada’s growing EV supply chain.”

For General Motors, the plant is crucial as it will provide some of the most important parts of its EV Ultium batteries that will be used in its EVs, such as the Chevrolet Silverado EV, GMC HUMMER EV, and Cadillac LYRIQ. CAM consists of all the prime materials, including processed nickel and lithium, which account for roughly 40% of the battery’s cost. GM is also building three Ultium battery manufacturing plants in North America, one each in Ohio, Tennessee, and Michigan.

Is GM a Good Buy Right Now?

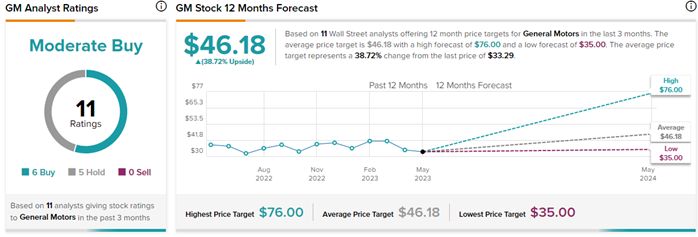

General Motors is pacing ahead with its EV manufacturing and battery materials projects. Having said that, macroeconomic challenges are slowing its progress, making analysts split on their view of GM stock. Year-to-date, GM stock has lost 1.3%.

On TipRanks, the stock has a Moderate Buy consensus rating based on six Buys and five Hold ratings. Also, the average General Motors price forecast of $46.18 implies 38.7% upside potential from current levels.