General Motors (NYSE:GM) is going all-in on electric vehicles (EVs). However, the automaker’s shift to an all-electric future is facing demand challenges. According to a Wall Street Journal report, some of its influential dealers are urging the company to incorporate hybrid models into its product lineup. Their concern stems from the fear of potentially losing customers who may still not be ready to adopt EVs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the report, dealers serving on the company’s advisory committees have suggested that GM should consider adding hybrids to its offerings. This should help bridge the gap for customers seeking a middle path between traditional cars and EVs.

Factors Impacting EV Demand

The ongoing issue of persistently high interest rates has played a significant role in causing a decline in the demand for electric vehicles (EVs). Furthermore, increased competition and aggressive price wars have weighed on profit margins.

Earlier, GM announced its plans to invest $35 billion in EVs and autonomous vehicles from 2020 through 2025. Yet, given the current demand scenario, the addition of new EVs and hybrids to GM’s product lineup remains uncertain.

Meanwhile, let’s look at what the Street recommends for GM stock.

Is General Motors a Good Stock to Buy?

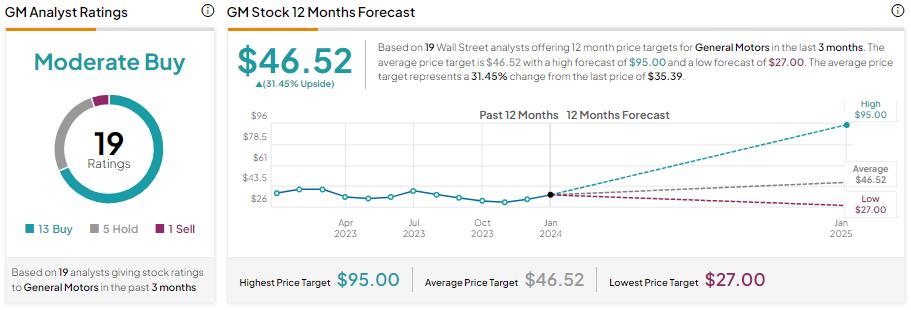

General Motors stock fell over 1% in one year, underperforming the broader market index. Meanwhile, analysts remain cautiously optimistic about its prospects as the company shifts towards EVs.

It has 13 Buy, five Hold, and one Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $46.52 implies 31.45% upside potential from current levels.