Global automaker General Motors Co. (NYSE:GM) has started a separate energy business labeled GM Energy through which it will manufacture batteries and energy storage equipment. The business will be supplementary to GM’s battery development arm for electric vehicles (EV).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

GM Energy will host three units: Ultium Home, Ultium Commercial, and Ultium Charge 360. The business will offer products including bi-directional charging equipment, vehicle-to-home (V2H) and vehicle-to-grid (V2G) equipment, stationary storage, solar products, and hydrogen fuel cells.

Notably, these batteries and power storage units would be sold to residential and commercial customers to help in powering their homes and complexes at times of outages. Customers will be given additional chargers, which will enable the transfer of power from these units to residences. GM is already running a pilot program with California’s Pacific Gas and Electric Company (PG&E) that allows residential customers to light up their homes in times of outages.

Additionally, for commercial customers, GM will provide an energy management software tool to enable the charging of their electric trucks and vans. Moreover, customers could also sell power from an EV or battery storage unit to the utility grid at peak times.

Commenting on the venture, Travis Hester, head of GM’s EV growth initiatives told WSJ, “We have become an expert battery manufacturer… It’s a natural evolution for us to move in here.” It is too soon to comment on the financial figures from the energy business. Also, the timeline for the launch of these products is not clear. However, the company hopes to provide investors with the same soon.

GM’s foray into the energy business marks a competition for rival EV maker Tesla (NASDAQ:TSLA), which already manufactures solar panels and battery storage units. The energy generation and storage market is valued at around $150 billion. GM Energy has already signed deals with several large companies for the products, including San Jose-based SunPower, which will manufacture home energy systems including EV battery solutions and solar panels.

Is GM a Buy or Sell?

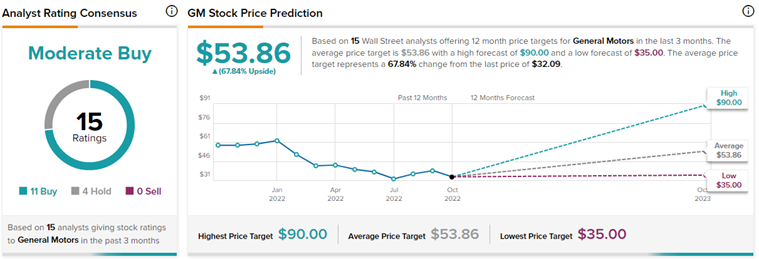

On TipRanks, General Motors stock has a Moderate Buy consensus rating. This is based on 11 Buys and four Holds. The average General Motors price forecast of $53.86 implies a whopping 67.8% upside potential to current levels. Meanwhile, the stock has lost 47.4% so far this year.