While many were looking at legacy automaker General Motors’ (GM) recent battery deal, it might be easy to forget that it is still primarily a gas-powered vehicle producer and seller. And it is looking to capitalize on that market by improving its position with several sport-utility vehicles (SUV). Investors took this merging of old and new quite fervently, sending shares up nearly 2.5% in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Several of GM’s biggest SUVs, particularly the Chevy Tahoe and the Chevy Suburban, are getting some upgrades for the 2025 model year. Both of these have been leaders in the “mainstream full-size SUV” market for the last 45 years, noted a CNBC report. However, rising competition in the SUV market, as customers prove to prefer the slightly bigger vehicles that often come with four-wheel drive, is giving GM a bit of a run for its money.

Thus, GM is pulling out at least some of the stops, adding its Super Cruise driver assistance system to Tahoe and Suburban this year, and giving customers a way to go hands-free with their driving, at least some of the time. Prices will still be pretty high, though, starting at $60,000 for the 2025 Tahoe and hitting over $86,000 for the best 2025 Suburban.

Is There Still Value in Cruise?

But what about Cruise? Some might wonder and with good reason. The self-driving car space is still a potentially huge market. With GM itself improving its position therein with Super Cruise, it is easy to wonder just how valuable the Cruise concept may be.

Granted, Cruise has had its share of problems. We have seen trouble in both safety and operational issues, and Cruise is still behind the eight ball when it comes to competitors who are, in many cases, farther along. But Cruise is still, at the very least, a valuable asset. There are even some who believe that GM’s current share price is not taking the value of Cruise into account, representing a potential opportunity in the making.

Is General Motors Stock a Good Buy Right Now?

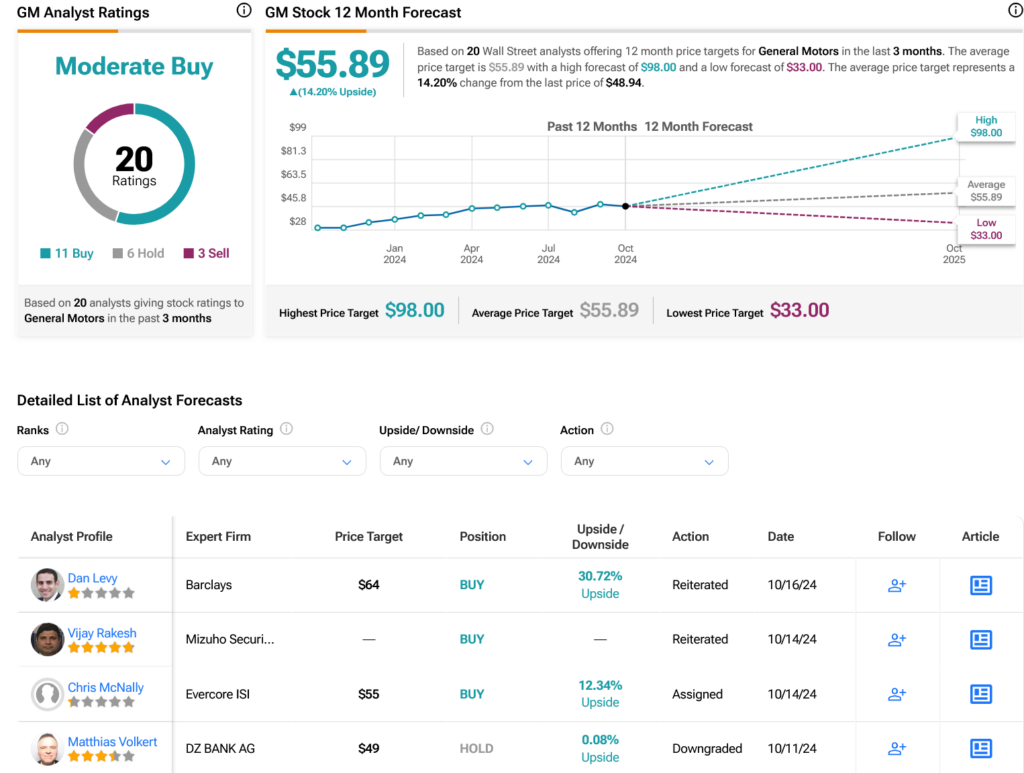

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GM stock based on 11 Buys, six Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 63.2% rally in its share price over the past year, the average GM price target of $55.89 per share implies 14.2% upside potential.