Multinational conglomerate General Electric (NYSE:GE) has been awarded a contract by the U.S. Air Force but has yet to set the terms, specifications, or price. The contract has a maximum value of $203 million for technology maturation and risk mitigation services and a $99.5 million cost-plus-fixed fee for research and development.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The work will be executed in Cincinnati, Ohio, and is likely to be completed by December 31, 2024.

General Electric is markedly benefiting from the continued recovery in the commercial market, which is driving orders in the Aerospace unit. In the third quarter, orders in this unit rose 6% year-over-year, whereas revenues grew 24%. Furthermore, the company expects full-year margins in the high teens for the Aerospace segment.

Is GE a Good Buy Right Now?

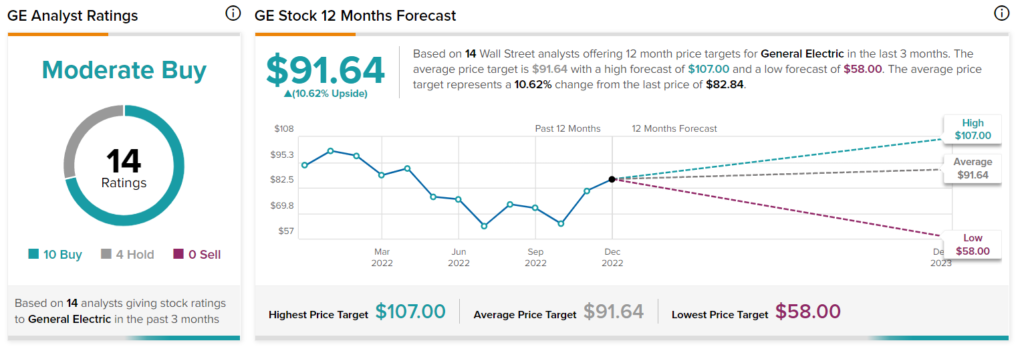

Wall Street is optimistic about General Electric stock, but carefully. The consensus rating for the stock is Moderate Buy based on 10 Buys and four Holds. The average price target of $91.64 indicates a 10.6% increase in the next 12 months.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.