To curb the growing losses, General Electric (NYSE:GE) has decided to cut 20% of its workforce at its US onshore wind facility, with potential job cuts in Europe and Asia to follow later, as reported by Bloomberg.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The move comes as a part of a greater restructuring of its renewable energy unit, which saw a massive drop in demand and resulting losses triggered by US tax credit uncertainty, rising inflation, and labor shortages.

Onshore wind is the largest part of the renewable businesses at GE. The unit reported a loss of $853 million during the first half of the year due to rising costs and supply chain challenges.

Is GE a Good Buy?

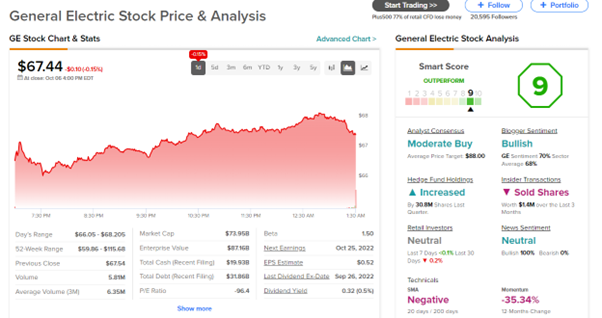

Analysts are cautiously optimistic about GE stock. It has a Moderate Buy consensus rating, based on nine Buys and four Holds. General Electric stock’s average price forecast of $88 implies 30.49% upside potential.

On October 3, Barclays analyst Julian Mitchell decreased the price target on General Electric to $78 (15.66% upside potential) from $81.

However, the analyst reiterated his Buy rating as he expects GE’s stock price could rebound following Q3 earnings (expected to release on October 25) due to lower expectations and cheap valuation.

Interestingly, GE stock has a positive signal from hedge fund managers, who added 30.8 million shares during the last quarter. Further, GE has a Smart Score of a 9 out of 10 on TipRanks.

Read full Disclosure