Multinational conglomerate General Electric (NYSE:GE) has had a mixed run of things for the last few years. It’s made some great strides and had a few setbacks. Now, it’s demonstrating that it can still do big things thanks to a new wind project that will call on GE products extensively. That was enough for investors to chip in and give GE stock a fractional boost in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As reports note, GE will be part of the largest wind project in the Western Hemisphere, as one of its businesses will produce hundreds of turbines for the project. It will also come with a long-term service agreement with Pattern Energy. Not only will it be the largest such project ever seen for wind, but it will be one of the largest energy projects ever. Some reports even compare it to the construction of the Hoover Dam.

Not All Smiles and Sunshine

That kind of good news generally has some trouble that comes along with it, and it’s no different here. Environmentalists are apparently—and bafflingly—concerned about the project’s location of a transmission line that will go through the San Pedro Valley in Arizona. Environmentalists and Native American tribes alike are concerned, saying they should have been consulted more before making the decision.

Is General Electric a Good Buy?

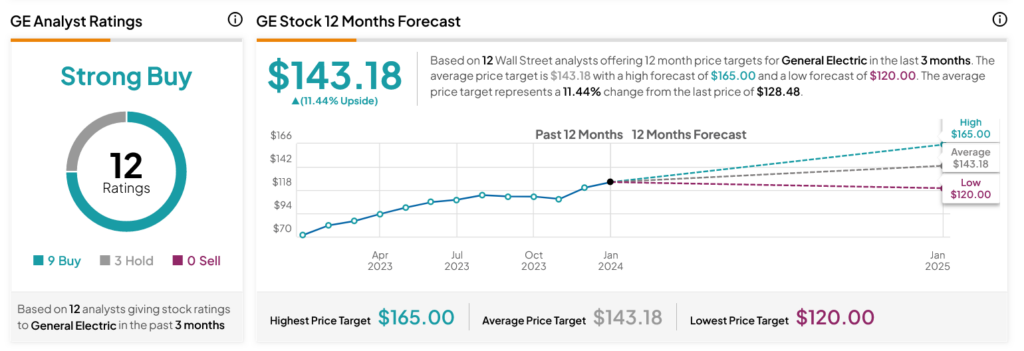

Turning to Wall Street, analysts have a Strong Buy consensus rating on GE stock based on nine Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 71.46% rally in its share price over the past year, the average GE price target of $143.18 per share implies 11.44% upside potential.