Cybersecurity stock Gen Digital (NASDAQ:GEN) may not be a name you recognize immediately. But when I mention that it’s the maker of Norton and Avast antivirus software, then that might ring a few bells. It’s certainly ringing bells for investors, though, as it’s up over 7.5% in Tuesday morning’s trading thanks to an earnings report that investors loved.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The earnings report proved a huge impetus for gain, as Gen Digital reported not only a rise in overall customer figures but also a record for quarterly revenue. While adjusted earnings didn’t exactly blow anyone away, coming in at $0.47 per share, which was in line with expectations, revenue proved a huge win. Indeed, revenue jumped 27% against this time last year and was also a new record.

There were also no nasty surprises waiting in regards to guidance, either. Gen Digital confirmed the previous range of between $950 million and $960 million for the third quarter of FY 2024 and also expects full-year revenue to come in between $3.81 billion and $3.835 billion. Reports suggest that Gen Digital has been enjoying some synergy-based wins since its inception when Avast and NortonLifeLock merged. There are also no signs that those synergies will slow up any time soon.

Is Gen Digital a Good Stock to Buy?

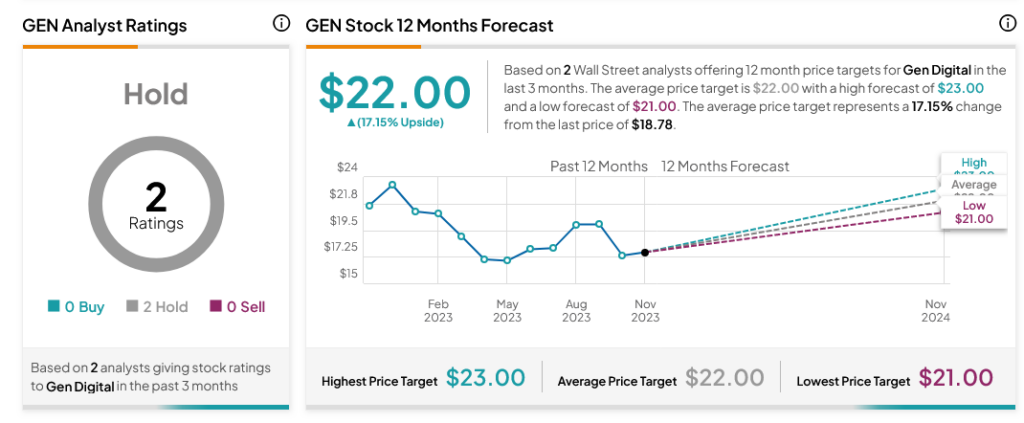

Turning to Wall Street, analysts have a Hold consensus rating on GEN stock based on two Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average GEN price target of $22 per share implies 17.15% upside potential.