GE Aerospace (NYSE:GE) announced better-than-expected Q1 results on Tuesday. The company’s consolidated results include the operations of both GE Aerospace and its energy business, GE Vernova (NYSE:GEV). GE Vernova was spun-off from GE after the end of the first quarter on April 2, 2024, and will report its results on April 25, 2024.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The consolidated results showed that GE generated adjusted revenues of $15.2 billion in the first quarter, up by 10% year-over-year on an organic basis. Analysts were expecting Q1 revenues of $15.3 billion. Adjusted earnings came in at $0.82 per share, surpassing consensus estimates of $0.65 per share.

On a standalone basis, GE Aerospace generated adjusted revenues of $8.1 billion, a growth of 15% year-over-year. The company reported operating profit of $1.5 billion, up by 24% year-over-year and clocked orders worth $11 billion in Q1, up by 34% year-over-year.

GE’s Future Guidance

Based on a strong start to the year, GE Aerospace raised its FY24 guidance and now expects operating profit to range from $6.2 billion to $6.6 billion as compared to its prior forecast between $6 billion and $6.5 billion. Adjusted earnings are likely to range from $3.80 to $4.05 per share in FY24.

Is GE a Good Buy Right Now?

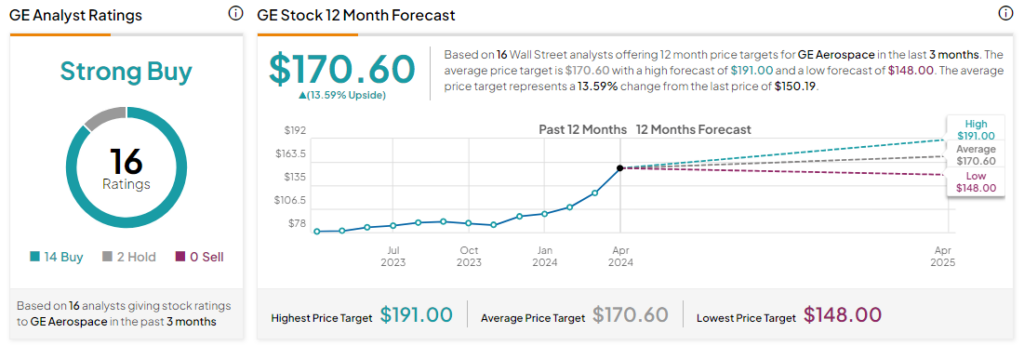

Analysts remain bullish about GE stock, with a Strong Buy consensus rating based on 14 Buys and two Holds. Year-to-date, GE has soared by more than 45%, and the average GE price target of $170.60 implies an upside potential of 13.6% from current levels. These ratings are likely to change following GE’s earnings today.