Biopharmaceutical company Ovid Therapeutics Inc.’s (OVID) product pipeline is targeted at neurological disorders. Its programs under development include: OV329, targeted at seizures associated with tuberous sclerosis complex and infantile spasms; OV882 for Angelman syndrome; and OV815 for KIF1A-associated neurological disorders.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s take a look at the company’s Q2 numbers, as well as what has changed in its key risk factors that investors should be aware of. (See Ovid Therapeutics stock charts on TipRanks)

Ovid did not generate any revenue during Q2. Its R&D expenses decreased to $7.7 million as compared to $16 million a year ago, due to the discontinuation of clinical development of OV101 in Angelman syndrome and Fragile X syndrome.

General and administrative expenses decreased to $6.6 million from $7.1 million a year ago, chiefly due to lower legal and professional fees. Net loss per share narrowed to $0.23 from a net loss per share of $0.41 a year ago but was wider than estimates by $0.07.

Ovid also has a commercial interest in enzyme inhibitor soticlestat, which is being advanced by Takeda (TAK), and is targeted at Dravet syndrome and Lennox-Gastaut syndrome. Phase 3 studies of the drug are expected to begin in 2021. If successful, soticlestat could receive regulatory approval in Fiscal Year 2023, according to Takeda.

On August 17, Ladenburg Thalmann & Co. analyst Michael Higgins reiterated a Buy rating on the stock with a $7 price target. Higgins commented, “We believe investors are not giving enough credit to soticlestat’s future milestones, which is driven by the uncertainty over Ovid’s future pipeline.”

The other analyst covering the stock, RBC Capital’s Brian Abrahams has a Hold rating on the stock with a price target of $4.

The two ratings add up to a Moderate Buy consensus. The average Ovid Therapeutics price target of $5.50 implies 51.1% potential upside for the stock. That’s after a 49% surge in share prices so far this year.

Risk Factors

Now, let’s have a look at what’s changed in the company’s key risk factors profile.

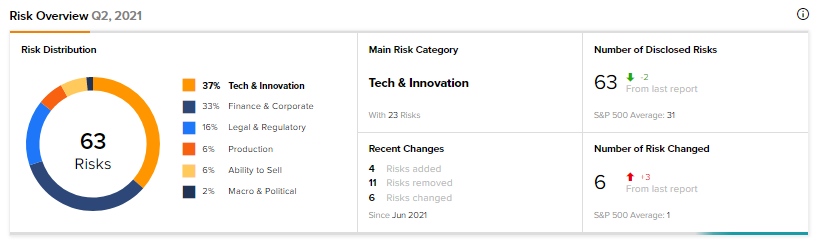

According to the new Tipranks Risk Factors tool, Ovid’s main risk categories are Tech & Innovation and Finance & Corporate, accounting for 37% and 33% respectively, of the total 63 risks identified. Since June, the company has added four key risk factors, three of which are under Tech & Innovation, while one is under Legal & Regulatory.

Ovid noted that all of its drug candidates are in preclinical development. If the company is unable to successfully develop, receive regulatory approval for, or commercialize its candidates, then its business may suffer.

Second, Ovid’s future performance depends partly on developing its gene therapy product candidates, OV882 and OV815. The approval process for novel gene therapy products can be expensive and take longer to complete.

Third, Ovid is entitled to royalty and milestone payments from Takeda in connection with the development and commercialization of soticlestat. If Takeda discontinues or fails to progress soticlestat, then Ovid may not receive some — or all — of these payments.

Under the Legal & Regulatory category, Ovid acknowledged that negative public opinion and higher scrutiny of gene therapy and genetic research by regulators may damage public perception of its products and negatively affect its ability to carry on business or obtain approvals for its product candidates.

Related News:

Applied Materials’ Q3 Results Surpass Estimates; Shares Fall 1.1%

Analog Devices Reports Record Q3 Results

A Look at Clorox’s Earnings and Risk Factors