Gap (NYSE:GPS) stock soared 17.1% in extended trading yesterday after exceeding third-quarter Fiscal 2023 earnings expectations. Gap reported adjusted earnings of $0.59 per share, significantly higher than the consensus estimates of $0.20 per share. In the year-ago period, GAP recorded an adjusted profit of $0.71 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, Gap’s quarterly sales fell 6.7% year-over-year to $3.77 billion but managed to beat the consensus of $3.61 billion. Comparable-store sales also declined 2% compared to the prior-year period. Gap has been witnessing a steady decline in same-store sales in the past few quarters due to store closures.

Even so, Gap’s gross margins and balance sheet are improving as the company focuses on reinvigorating the brand portfolio and streamlining expenses. Gap cautioned about a weak holiday season ahead and expects the fourth-quarter sales to be flat to marginally negative. Notably, the company is on track to open 15-20 Old Navy and Athleta stores while closing 350 Gap and Banana Republic stores in North America this year.

Is Gap a Good Stock to Buy Now?

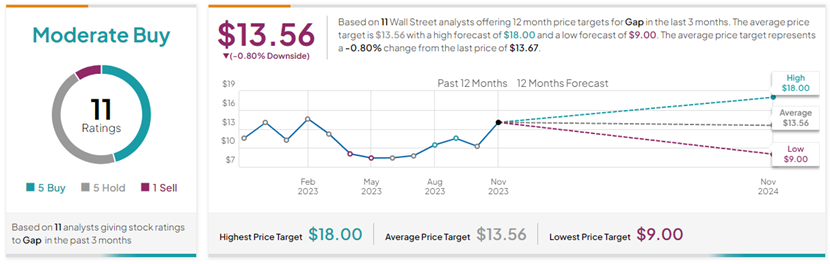

Wall Street remains cautiously optimistic about Gap’s stock trajectory. On TipRanks, Gap has a Moderate Buy consensus rating based on five Buys versus five Holds and one Sell rating. Also, the average Gap price forecast of $13.56 implies that shares are almost fully valued at current levels. Meanwhile, year-to-date, GAP stock has gained 26.3%.