A couple months ago, when the Gap (NYSE:GPS) rolled out its earnings report, it was clear something needed to change. And indeed, something did change: about 1,800 employees were put on the chopping block. A layoff that huge might ordinarily prompt cheers from investors, but Gap shares were up only a little over 1% in Thursday afternoon’s trading.

The Gap posted an EPS of -$0.40 instead of the expected -$0.46, while revenue dropped 6% year-over-year, falling to $4.24 billion and missing consensus estimates. Declining performance plus souring macroeconomic conditions add up to a terrible environment for a retailer and a clear need for some kind of solution.

Thus, the Gap took to paring back its employment roster and sent many workers packing. Interestingly, many of these cuts weren’t taking place in the storefronts but rather at the back office. Most of the laid-off workers will be those in “upper field” roles or headquarters staff. “Upper field” is the name for workers who hold leadership titles in satellite locations. As a result, management believes the inherent potential of the Gap and its various brands will have much more room to operate.

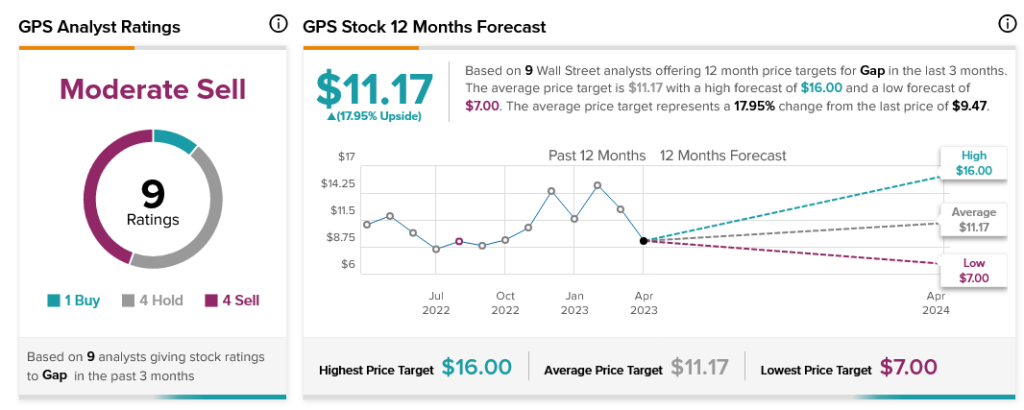

It’s clear something needs to be done at the Gap, as analysts have little faith. With one Buy rating, four Holds, and four Sells, Gap stock is considered a Moderate Sell by analyst consensus. However, with an average price target of $11.17, it offers investors 17.95% upside potential.