Last year one market watcher made a mistake. When evaluating GameStop’s (NYSE:GME) prospects, investor Daniel B. Wilson looked at the company’s fundamentals and came to the conclusion consensus revenue expectations for the videogame retailer were too high and that the shares were trading around 67.5% above their fair value.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yet, Wilson’s thesis fell short. It wasn’t that his assessment of revenue expectations was off – indeed, they did fall short of the Street’s forecast. Rather, Wilson now acknowledges that analyzing GameStop from a fundamental point of view misses the mark.

“I overestimated the importance of GameStop’s intrinsic value in my initial analysis,” says Wilson. “Almost all of Gamestop’s value as an investment comes from the possibility of a future meme rally.”

GameStop remains a problematic proposition on a fundamental level, with a shrinking ecommerce business, failed NFT endeavors (remember them?), a seemingly doomed core brick-and-mortar business, job cuts to save costs, and making exits from several international markets. Meanwhile, Wilson thinks CEO Ryan Cohen “doesn’t have a plan to turn the company around.”

But GameStop stock does have an ace up its sleeve in the shape of Keith Gill, aka Roaring Kitty. It was Gill who set in motion the meme stock mania in the first place, spotting the opportunity inherent in GME shares, a maverick move that culminated in 2021’s meme stock craze. Those heady times delivered unseemly gains for GME investors and for those holding shares of other iffy companies. And it was Gill who via a simple tweet was responsible for the recent meme stock renaissance.

“Keith Gill is the most likely person to start another meme rally, in my view because he was directly involved in the meme rallies in 2021 and 2024,” opines Wison. Good work, Sherlock.

So, what’s the chance of that happening? Well, Gill could post again and bring about more meme shenanigans.

“I assume there’s a 35% chance of another meme rally (a very rough guess based on my opinions),” says Wilson. “I recommend selling out at $40/share if that’s the case.”

That will yield returns of 77% from current levels, although it doesn’t look like Wilson will be waiting around for such a scenario as he currently rates the shares a Sell. (To watch Wilson’s track record, click here)

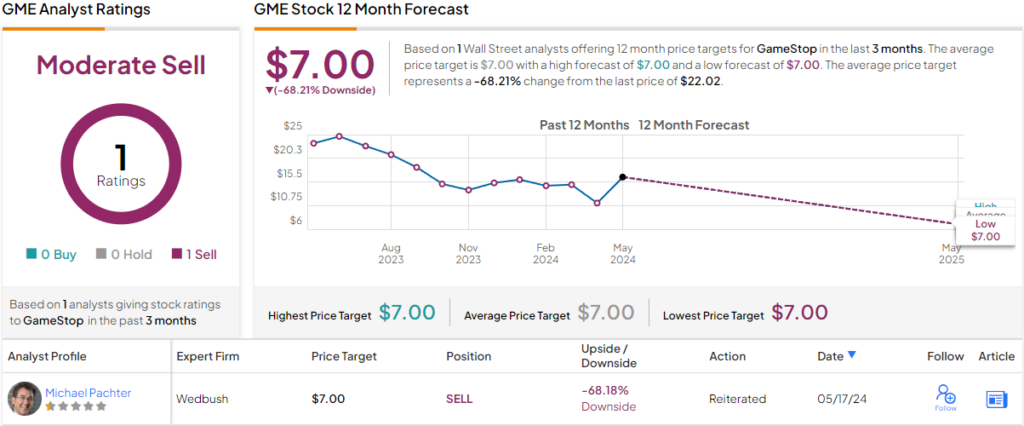

Turning now to the Wall Street view, where only one analyst is currently tracking GME’s progress, and like Wilson, they consider the stock a Sell, too. At $7, their price target implies a ~68% downside from the current share price of $22.03. (See GameStop stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.