fuboTV (NYSE:FUBO) shares are on the rise today after the streaming services provider delivered better than expected second quarter numbers with revenue soaring 40.9% year-over-year to $312.7 million. Additionally, net loss per share at $0.17 came in narrower than estimates by $0.13.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

North America revenue soared 41% year-over-year to $305 million with the number of paid subscribers in the region rising 23% year-over-year to ~1.17 million. Further, revenue from the Rest of World vertical rose by 40% over the prior year to $8.2 million with a 14% jump in paid subscribers to 394,000.

The company had a cash pile of $299.7 million at the end of the quarter. Looking ahead, for Q3, revenue from the North America segment is expected to rise by 25% at the midpoint of the range between $272.5 million and $277.5 million.

For the full-year 2023, FUBO expects the number of paid subscribers in North America to hover between 1.565 million to 1.585 million. Revenue from the region is anticipated between $1.26 billion and $1.28 billion. This points to an impressive 29% year-over-year growth at the midpoint of the outlook.

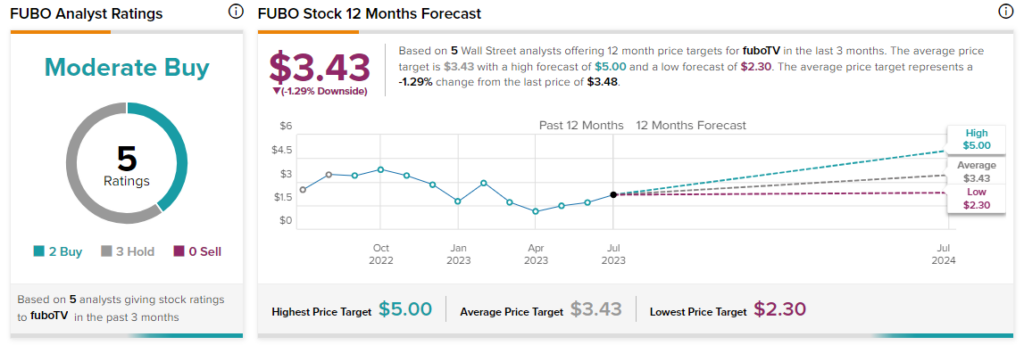

Overall, the Street has a $3.43 consensus price target on FUBO alongside a Moderate Buy consensus rating. Shares of the company have now surged nearly 107% so far this year.

Read full Disclosure