Frontline (NYSE:FRO) shares dropped nearly 7% in the early session today after the shipping company delivered a mixed set of third-quarter results. While revenue decreased by 1.3% year-over-year to $377.1 million, the figure still exceeded estimates by $124.7 million. On the other hand, EPS of 0.36 lagged expectations by $0.11.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, lower TCE (Time Charter Equivalent) rates resulted in Frontline’s time charter equivalent earnings decreasing to $229.1 million from $352.3 million in the previous quarter. Consequently, the company’s adjusted profit declined to $80.8 million from $210 million in the previous quarter.

Despite a tough macroeconomic backdrop, the company experienced normal seasonality return and a pickup in freight demand towards the end of the quarter. Still, it expects spot TCEs in the upcoming quarter to be lower than the currently contracted TCEs.

In another development, Frontline and Euronav (NYSE:EURN) have reached an integrated solution to their structural deadlock. Frontline has sold 13.7 million shares of Euronav to CMB for $252 million and agreed to acquire 24 VLCCs (Very Large Crude Carrier) from Euronav for $2,350 million. A majority of these vessels are expected to be delivered in the fourth quarter. This move is expected to increase Frontline’s tanker footprint by over 30%.

Additionally, the company has declared a quarterly dividend of $0.30 per share. The FRO dividend is payable on December 29 to investors of record on December 15.

What Is the Target Price for FRO?

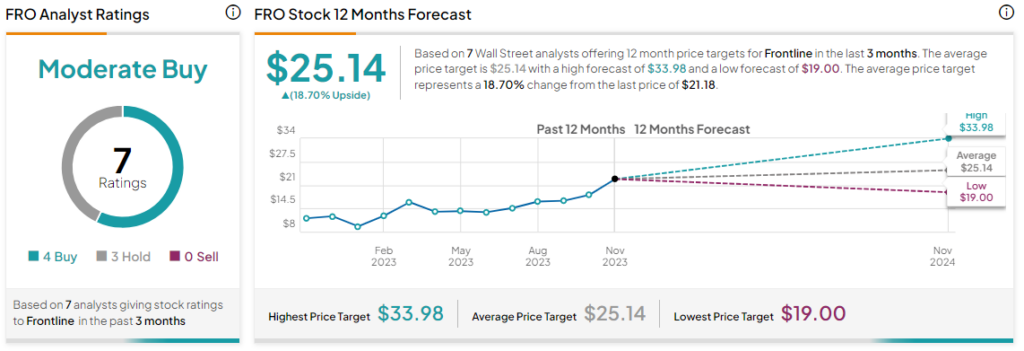

Overall, the Street has a Moderate Buy consensus rating on Frontline, and the average FRO price target of $25.14 implies an 18.7% potential upside. That’s on top of a nearly 41% rise in the share price over the past six months.

Read full Disclosure