Frontier (NASDAQ:FYBR) was often the first high-speed internet provider for many rural users, although it was not always the best performing. However, according to Morgan Stanley analyst Simon Flannery, Frontier’s outlook is not optimistic. This led to a 9% drop in Frontier’s stock during Monday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Flannery downgraded Frontier from “market perform” to “underperform,” citing concerns about the company’s high stock valuation compared to its competitors. Additionally, with fixed wireless services becoming more competitive, Frontier may face more challenges.

Despite this, Frontier is not backing down. Flannery acknowledged that the company is expected to build 1.3 million fiber connections in a year and add 309,000 new customers this year, with another 388,000 expected to join next year. Furthermore, Frontier has teamed up with YouTube TV to offer customers a convenient streaming service that can be added to their accounts and billed in one place.

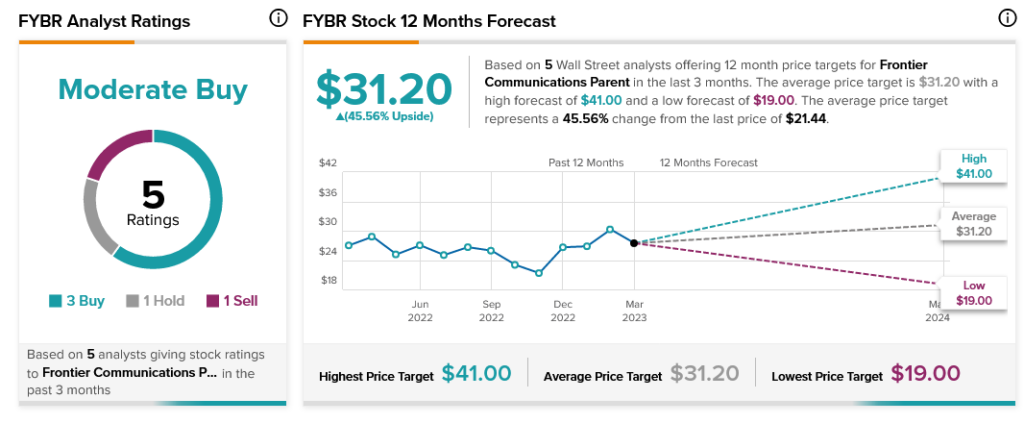

Overall, analysts seem a bit hesitant overall about Frontier. Analyst consensus considers it a Moderate Buy, but with a makeup of three Buy recommendations, one Hold, and one Sell, it’s clear the pool is pretty split. However, there’s healthy upside potential here; thanks to its average price target of $31.20, Frontier stock boasts a 45.56% upside potential.